Summer got off to anything but a lethargic start, with U.S. growers declaring intentions to devote the most acreage to dry hay since 2014. As Progressive Forage recapped last month, the U.S. hay acreage outlook was driven by hay prices, inventories and exports, along with improved moisture conditions in the Northern Plains.

Now that the 2018 hay production season has progressed, other market factors have been showing their teeth.

Hay exports steady in June, but change likely

U.S. hay exports were mostly steady in June (the latest data available as of early August). Alfalfa hay shipments totaled 234,421 metric tons (MT), the highest monthly total in a year and the fourth straight month export volumes topped 200,000 MT. The month's exports were valued at $73 million.

China's June total of 88,110 MT was on par with the January-May average. At 57,296 MT, Saudi Arabia's purchases were the highest of the year, while shipments to Japan, South Korea and the United Arab Emirates (UAE) were similar to January-May averages. Sales of dehydrated alfalfa meal and cubes were steady.

Sales of other hay totaled 114,054 MT in June. Those shipments were valued at $37.4 million. Sales to Japan were the highest in three months, while shipments to South Korea, Taiwan, UAE and China followed recent trends.

While June provided a steady hay export market, that's changing, said Christy Mastin of Eckenberg Farms Inc. in Mattawa, Washington. The biggest threat is the tariff war with China, where a 25 percent retaliatory tariff, implemented on July 6, has added about $84 per MT to the cost of alfalfa hay imported from the U.S.

“What we have seen is that [Chinese] customers with direct connection to a dairy continue to purchase,” Mastin said. “Customers that are brokers with no real direct relationship with a dairy have stopped U.S. purchases and are looking to Spain and Canada for a cheaper supply of alfalfa. If this tariff continues, more purchasers will move away from U.S. alfalfa.”

Beyond China, the alfalfa market should be good for all other countries, Mastin said. However, Asia has had extremely hot and humid weather, suppressing cattle feed consumption. “They are concerned that this will take time for cows to increase their feed intake. We don't know how long this hot weather will last,” Mastin said.

Weather-related issues in Japan mean that country should remain a steady buyer of U.S. alfalfa. However, Pacific Northwest weather negatively impacted the U.S. timothy crop, pushing prices higher.

“It will take time for the market to accept these prices,” Mastin said. “Many Japanese customers are waiting to see what the harvest in Canada does. If forage of lower price but similar quality can be purchased there, then some Japanese customers will shift from the U.S. to Canada.”

Another competitor for other hay from the U.S. is oaten hay from Australia. Current sales have competitive prices and great quality. The harvest for new crop doesn't start until September and October.

Dairy remains weak

Back home, a slightly optimistic outlook for dairy turned sour, as global milk production and product inventories, along with U.S. trade tariff wars with two primary customers – Mexico and China – dampened cash and futures prices. The same tariffs brought down feed prices somewhat, and June milk income margins actually improved slightly. However, weak dairy prices in July will send margins lower again. Margin Protection for Dairy (MPP-Dairy) payments are mounting, and the USDA is expected to infuse additional cash into stressed dairy farmer bank accounts after Labor Day to offset the negative impact of the tariffs on exports and prices.

Dairy farmers' walks to the mailbox have not been fun this year. Through the first four months of 2018, average Federal Milk Marketing Order “mailbox prices” – the net milk price received by dairy farmers after deducting costs associated with hauling and marketing – were about $2.25 per hundredweight (cwt) less than the same period in 2017. For those with a longer memory, average mailbox prices were running $9 to $10 per cwt less than the record highs of 2014.

The combination of higher hay prices and low milk prices has impacted alfalfa feeding rates. Quarterly feed cost data from California's Department of Food and Agriculture showed first-quarter alfalfa hay inclusion rates in Holstein dairy cow rations dipped to about 7.7 pounds per day, matching a long-term low set in the third quarter of 2017. For California Jerseys, alfalfa hay inclusion rates slipped to less than 4.4 pounds per day in the first quarter of 2018.

Pressured by low income margins, a USDA July quarterly report estimated replacement cow prices have fallen to an eight-year low.

There are areas of dairy expansion, however. Compared to a year earlier, June dairy cow numbers continue to grow in Colorado (+17,000), Texas (+11,000) and Kansas (+7,000). That's in contrast to declines in California (-14,000), Minnesota and Ohio (each -5,000), and Michigan, Pennsylvania and Wisconsin (each -4,000).

It's a little drier

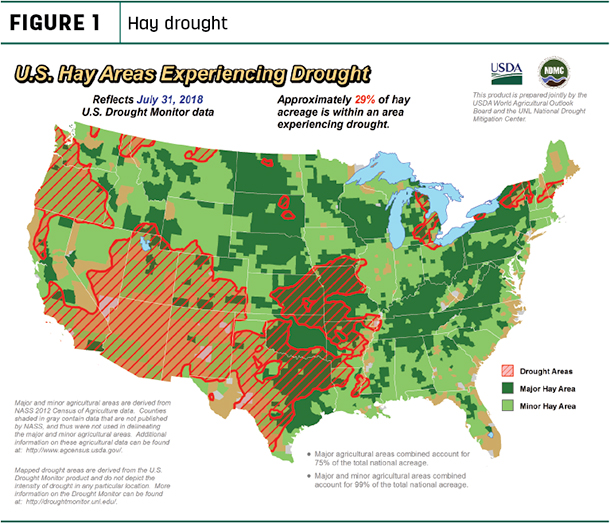

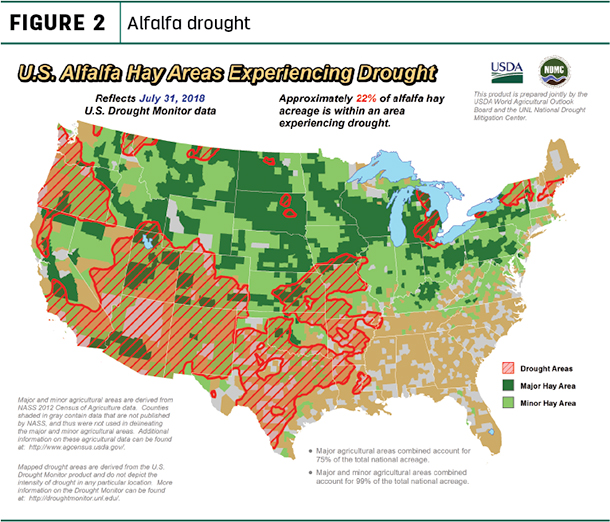

The USDA's World Agricultural Outlook Board reported an increase in hay production areas under drought conditions. About 29 percent of U.S. hay-producing acreage was located in areas experiencing drought as of July 31, up 6 percent from a month earlier (Figure 1). About 22 percent of alfalfa hay acreage was in the same condition (Figure 2), up 2 percent. Conditions improved in north central California, but deteriorated in Oregon, eastern Michigan and parts of New England.

See current drought conditions.

Hay prices moderate

The latest available USDA monthly Ag Prices report summarized June 2018 prices.

Alfalfa

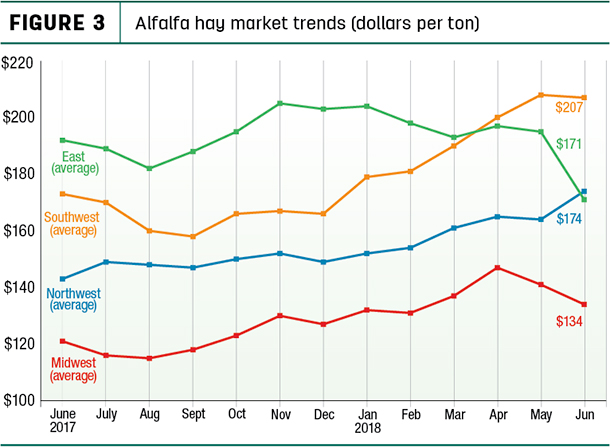

After peaking in May, national average alfalfa hay prices moderated in June. At $181 per ton, the June 2018 U.S. average price was down $8 from May but still $27 more than June 2017. Regionally, prices declined in the East and Midwest, and steadied in the Southwest, but rose in the Northwest (Figure 3).

Compared to a month earlier, June average alfalfa hay prices declined $57 per ton in New York and between $23 and $40 per ton in Minnesota, Michigan, Ohio, Illinois and Wisconsin. Prices rose $10 to $20 per ton in Utah, Missouri, Indiana, Idaho, Colorado, Arizona, Washington and Oregon. The highest average alfalfa hay prices were in the drought-stricken Southwest and in Tennessee and Kentucky. The low prices for the month could be found in South Dakota, North Dakota and Minnesota.

Other hay

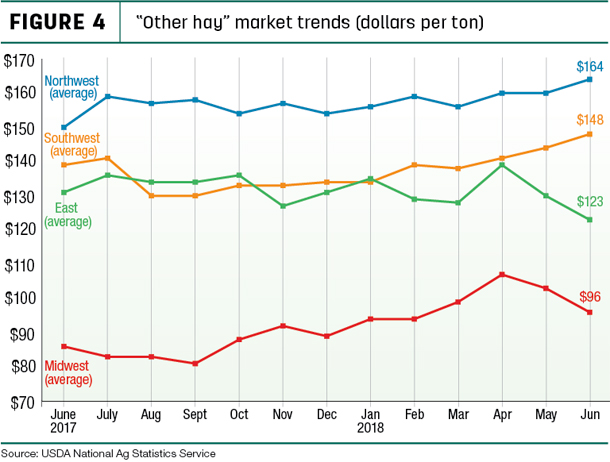

The U.S. average price for other hay was estimated at $121 per ton, down $1 from May and $4 less than June 2017. Regionally, June 2018 average prices continued to fall in the East and Midwest, but posted small increases in the Northwest and Southwest (Figure 4).

Among individual states, Oregon, California, Colorado and Nevada saw the largest price increases from May, up $10 to $20 per ton. Substantial price declines were in Indiana (-$50) and Michigan (-$35); moderate declines of $10 to $20 per ton were in Minnesota, Oklahoma, Kansas, New York, Iowa and Ohio. The highest average prices for other hay hit $200 or more per ton in Washington, Arizona and Colorado, in contrast to the monthly low of $70 per ton in North Dakota and Nebraska.

Figures and charts

The prices and information in Figure 3 (alfalfa hay market trends) and Figure 4 (“other hay” market trends) are provided by NASS and reflect general price trends and movements. Hay quality, however, was not provided in the NASS reports. For purposes of this report, states that provided data to NASS were divided into the following regions:

- Southwest – Arizona, California, Nevada, New Mexico, Oklahoma, Texas

- East – Kentucky, New York, Ohio, Pennsylvania, Tennessee, Virginia

- Northwest – Colorado, Idaho, Montana, Oregon, Utah, Washington, Wyoming

- Midwest – Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, South Dakota, Wisconsin

Organic hay

According to the USDA's organic hay report, released Aug. 1, FOB farm gate organic hay prices were as follows:

- Supreme alfalfa large square bales – $265 to $290 per ton

- Premium alfalfa large square bales – $240 per ton

- Supreme alfalfa small square bales – $255 per ton

- Premium alfalfa small square bales – $250 per ton

No prices were reported for delivered organic hay.

Regional conditions

Here's a snapshot of early August conditions:

- East: In Pennsylvania, all varieties of hay and straw sold mostly steady with some weakness noted in small bales of alfalfa-grass blended hay.

-

Southwest: Many parts of Oklahoma received much-needed rain at the end of July, but amounts were not enough to lessen drought concerns. Third-cutting alfalfa was close to completion, with much of central Oklahoma beginning fourth cutting. Grass hay baling was very active; trading was mostly moderate and most sales were local.

In Texas, hay prices continued mostly steady, with instances of $5 higher. Many areas reported good demand for hay, but supplies were limited and prices were expected to move higher. Northeast Texas remained extremely dry, and producers there were only on their second cutting.

In New Mexico, alfalfa hay prices were unchanged. Southern and southwestern areas were 50 to 70 percent into the fourth cutting. The southeastern region was 20 to 40 percent into the fourth cutting. North central areas were between 70 and 90 percent into the third cutting, but rain put producers behind on the fourth cutting.

-

Northwest: In Idaho, trade was very active with good demand, especially for non-rained-on dairy hay for immediate take out. Exporters were buying mostly Fair- to Good-testing alfalfa. Rained-on feeder hay remained in good demand.

In Montana, trade activity and demand were moderate; sales were light. Producers were getting calls from out-of-state buyers located where drought has affected hay supply.

In Wyoming, hay demand was light to moderate from cow-calf ranchers, with good demand from horse owners. Demand for alfalfa cubes was very good from horse owners and cattlemen alike. Most cattlemen are dragging their feet on the asking price of the baled hay, hoping it will sell at a lower price later this summer.

In the Washington-Oregon Columbia Basin, trade was slow to moderate as dairies and exporters remained cautious. High-testing alfalfa was in short supply. Most producers were working on third-cutting alfalfa and second-cutting timothy. High temperatures reduced the relative feed value tests on alfalfa.

Southwest Colorado grass hay producers reported that they will only have one cutting available to market this year, resulting in the current price spike. Prices for horse-quality hay have steadied due to hay shortages across the state.

-

Midwest: In Iowa, buyers were aggressively looking for good-quality bedding and high-quality dairy hay. Most of Iowa had baled its second cutting, with most sellers offering both the first and second cutting. Aggressive buyers allowed the top side of hay to hold, while the lower quality prices drifted lower.

For Missouri, hay supplies were light, demand was very good and hay prices were steady to higher. Ongoing drought has increased phone inquiries for hay.

In southwest and south central Kansas, demand remained very good for all hay types. Harvest of third-cutting alfalfa was well underway or near completion; grass hay baling was all but over.

In Nebraska, prices for alfalfa round bales were still up in the air. Grass hay production continued at a snail's pace, plagued by moisture. Second-cutting tonnage on alfalfa was very good, with some reports indicating yields were better than the first cutting. A few producers had started on the third cutting.

In South Dakota, demand was light for low-quality grinding cow hay, moderate to good for higher testing hay more suited for dairies. Third-cutting alfalfa was underway and showing potential to be some of the higher quality hay so far for the year.

In southwest Minnesota, little dairy-quality hay was available.

In Wisconsin, there was a large hay inventory, but much is lower quality. Quality hay is bringing good prices.

Other market factors

-

Beef outlook: The U.S beef cattle sector is well into the cyclical adjustment phase, transitioning from aggressive herd expansion to very modest growth, according to the Livestock Marketing Information Center. If recent herd trends persist, 2020 could mark the end of the current U.S. cattle inventory buildup.

-

Interest rates: Meeting Aug. 1, the Federal Reserve board voted to hold off on raising interest rates. Nonetheless, early information from the Dallas district Federal Reserve banks showed interest rates on second-quarter 2018 variable- and fixed-rate loans were at highs last seen in 2010-12.

-

Fuel prices: U.S. average fuel prices moved higher to end July. At $2.85 per gallon, the national average regular gasoline retail price was nearly 50 cents higher than a year earlier. At $3.23 per gallon, the U.S. average diesel fuel price was up almost 70 cents from a year ago. The U.S. Energy Information Administration (EIA) forecasts U.S. retail prices to remain flat in the coming months and into 2019.

-

Dave Natzke

- Editor

- Progressive Forage

- Email Dave Natzke