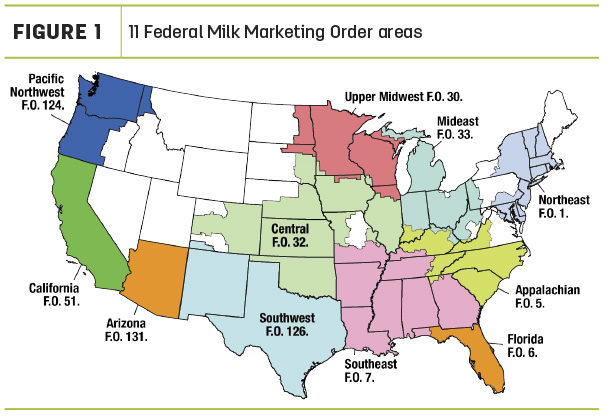

Administrators of the 11 Federal Milk Marketing Orders (FMMOs – see Figure 1) reported March 2022 uniform milk prices, producer price differentials (PPDs) and milk pooling data, April 11-13. Here’s Progressive Dairy’s monthly review of the numbers and their potential impact on your milk check.

Class, uniform prices continue to climb

FMMO statistically uniform milk prices were up in March, while the spread between milk class prices again impacted handler pooling and the “Class I mover.”

Prices for all individual classes of milk were up from February:

- At $22.88 per hundredweight (cwt), the March advanced Class I base price was up $1.24 from February 2022 and $7.68 more than March 2021. It was the highest since November 2014. Adding Class I differentials for each order's principal pricing point, the March Class I price averaged $25.70 per cwt, with a high of $28.28 per cwt in the Florida FMMO and a low of $24.68 per cwt in the Upper Midwest FMMO.

Compared to the old “higher-of” formula used to calculate the Class I mover, the “average-of plus 74 cents” formula took a bigger chunk out of the possible Class I price paid to producers in March. At $3.12 per cwt, the difference between the advanced Class III skim milk pricing factor ($10.59 per cwt) and the advanced Class IV skim milk pricing factor ($13.71 per cwt) grew substantially. Based on Progressive Dairy calculations, the Class I mover calculated under the higher-of formula would have resulted in a Class I base price of $23.67 per cwt, 79 cents more than the price determined using the average-of plus 74 cents formula. The effect within individual FMMOs depends on Class I utilization, with the largest impact on Appalachian, Florida and Southeast orders.

- The March Class II milk price was $24.76 per cwt, up nearly $1 from February.

- The March 2022 Class III milk price rose $1.54 from February to $22.45 per cwt, the highest since November 2020, when government purchases of cheese for food boxes pushed prices up. The Class III price was up $6.30 from March 2021.

- At $24.82 per cwt, the March 2022 Class IV milk price hit another record high, rising 82 cents from February; it was $10.64 more than March 2021.

Component values, tests

March Class III-IV milk prices moved higher thanks to increases in values of butterfat, protein and milk solids used in monthly milk price calculations.

- The value of butterfat rose more than 7 cents from February to $3.09 per pound.

- The value of milk protein jumped more than 40 cents to $2.72 per pound, the highest since last November.

- The value of nonfat solids rose more than 6.5 cents to $1.61 per pound, while the value of other solids increased about 1.5 cent to 61 cents per pound.

In FMMOs reporting component tests for pooled milk, average butterfat and protein tests were down slightly from February. In a few FMMOs providing preliminary somatic cell counts (SCC), milk quality improved slightly from February.

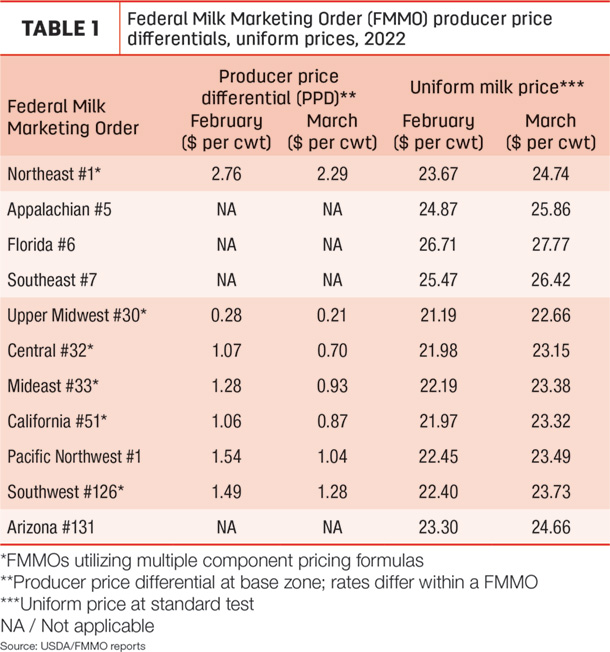

Uniform prices higher

With higher individual milk class prices, March blend or uniform prices at standardized test rose in all FMMOs (Table 1) and in most cases were the highest since October 2014. When multiplied by milk class utilization in each FMMO, March uniform prices increased in a range of 95 cents to $1.47 per cwt across all 11 FMMOs compared to February. The high uniform price for March was $27.77 per cwt in the Florida FMMO #6; the low was $22.66 per cwt in the Upper Midwest FMMO #30.

March baseline PPDs were positive but slightly lower than February, down in a range of 7-50 cents (Table 1).

As we remind you each month, PPDs have zone differentials within each FMMO. Also, whether positive or negative, individual milk handlers apply PPDs and other deductions to milk checks differently.

Impact on pooling

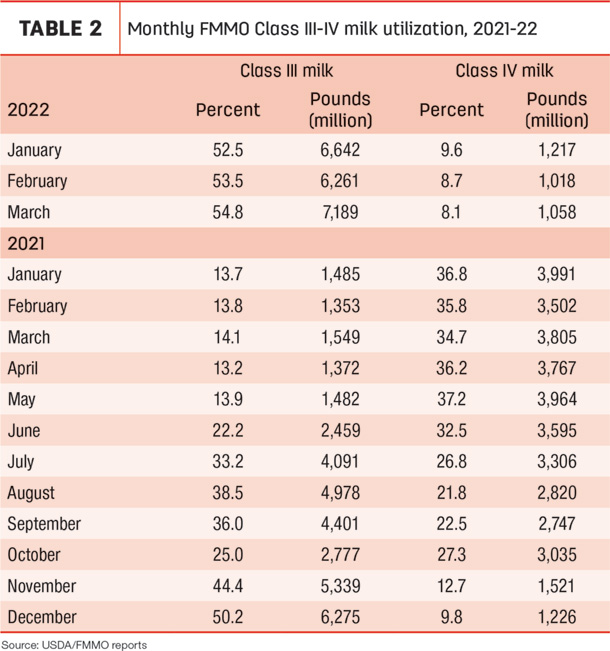

You can get a general picture of FMMO pooling-depooling in a couple of ways: on a volume basis, comparing monthly pooling totals to previous months, and on a percentage basis, comparing the percent utilization of a specific class of milk relative to all milk pooled that month.

Looking at March data, about 13.1 billion pounds of milk were pooled on federal orders, up about 1.4 billion pounds from February. Factoring into that increase, of course, is the longer month.

The March Class III-IV price relationship maintained a $2.37-per-cwt spread. Additionally, the Class IV price was close to the March FMMO average Class I milk price of $25.70 per cwt, which includes zone differentials. Those factors provided incentives for Class IV depooling.

Class IV milk pooled across all FMMOs inched upward to about 1.058 billion pounds (Table 2) in March. However, with total milk pooled also higher, March 2022 Class IV milk utilization represented about 8.1% of total FMMO milk marketings, a pre-2018 low.

The March Class III-IV milk relationship again had an opposite impact on Class III pooling. With the Class III milk price below the Class IV price, Class III handlers brought more milk back to the pool. On a volume basis, Class III milk pooled in March was estimated at about 7.189 billion pounds, the most since June 2019 and 5.6 billion more than March 2021. As a percentage of utilization, Class III milk represented about 54.8% of the total FMMO pool, the highest since pre-2018.

Looking ahead

Class and uniform prices will move higher for April milk marketings, but some incentives for Class IV milk depooling will remain.

Already announced, the April 2022 advanced Class I base price is $24.38 per cwt, up $1.50 from March 2022 and $8.87 more than April 2021. It’s just 9 cents below the record high of $24.47 per cwt in May 2014. Adding zone differentials, April 2022 Class I prices will average $27.20 per cwt, ranging from a high of $29.78 per cwt in the Florida FMMO #6 to a low of $26.18 per cwt in the Upper Midwest FMMO #30.

The average-of plus 74 cents Class I mover formula will take a smaller bite out of the Class I price. The difference between the April advanced Class III skim milk pricing factor ($11.97 per cwt) and the advanced Class IV skim milk pricing factor ($14.51 per cwt) declined slightly from March to $2.54 per cwt.

Based on Progressive Dairy calculations, the Class I mover calculated under the higher-of formula would have resulted in a Class I base price of $24.89 per cwt, 51 cents more than the price determined using the average-of plus 74 cents formula.

April Class II, III and IV milk prices will be announced on May 4. At the close of Chicago Mercantile Exchange (CME) trading on April 13, the April Class III futures price was $24.22 per cwt, up $1.77 from March. The April Class IV futures price settled at $25.25 per cwt, up another 43 cents per cwt from March. If those prices hold, the Class III-IV price spread would shrink to about $1.03 per cwt.

Longer term, as of April 11, Class III futures prices averaged $23.57 per cwt for all of 2022, with Class IV futures averaging $24.63 per cwt. The spread between the Class III-IV futures prices averages about $1.06 for the year, maintaining smaller Class IV depooling incentives.

Individual FMMO pooling, depooling and repooling rules play a role in how much. And milk markets change.

2021 all-milk, mailbox prices compared

Also affecting the bottom line of your milk check are deductions for marketing. Full-year 2021 “mailbox” prices averaged about $1 per cwt less than announced average “all-milk” prices for the same period, based on an updated look at two USDA milk price announcements.

The all-milk price is the estimated gross milk price received by dairy producers for all grades and qualities of milk sold to first buyers, before marketing costs and other deductions. The price includes quality, quantity and other premiums, but hauling subsidies are excluded. The mailbox price is the estimated net price received by producers for milk, including all payments received for milk sold and deducting costs associated with marketing.

During 2021, all-milk prices averaged $18.69 per cwt, up 45 cents from the $18.24 average in 2020. The 2021 weighted average mailbox price averaged $17.69 per cwt, up 73 cents from $16.96 per cwt in 2020.

With market disruptions from the COVID-19 pandemic, including depooling and negative PPDs, the spread between all-milk and mailbox prices had hit a record $1.28 per cwt in 2020.

Read: All-milk, mailbox price spread shrunk a little in 2021.

The difference in the two announced prices can affect dairy risk management, since indemnity payments under the Dairy Margin Coverage (DMC), Dairy Revenue Protection (Dairy-RP) and Livestock Gross Margin for Dairy (LGM-Dairy) programs are all based on the all-milk price, before any marketing cost deductions.