As the growing season progresses, the difference moisture makes is becoming abundantly clear. While most markets are remaining steady and the demand for hay is good, heavy rains have delayed the haying season in many parts of the country. While high-testing hay is unable to be harvested due to the excess moisture, the parts of the country that are still suffering from drought are in need of some relief. Overall, the hay season is well into the second cutting for most of the country, and most hay stores from 2022 are depleted.

Moisture conditions more critical

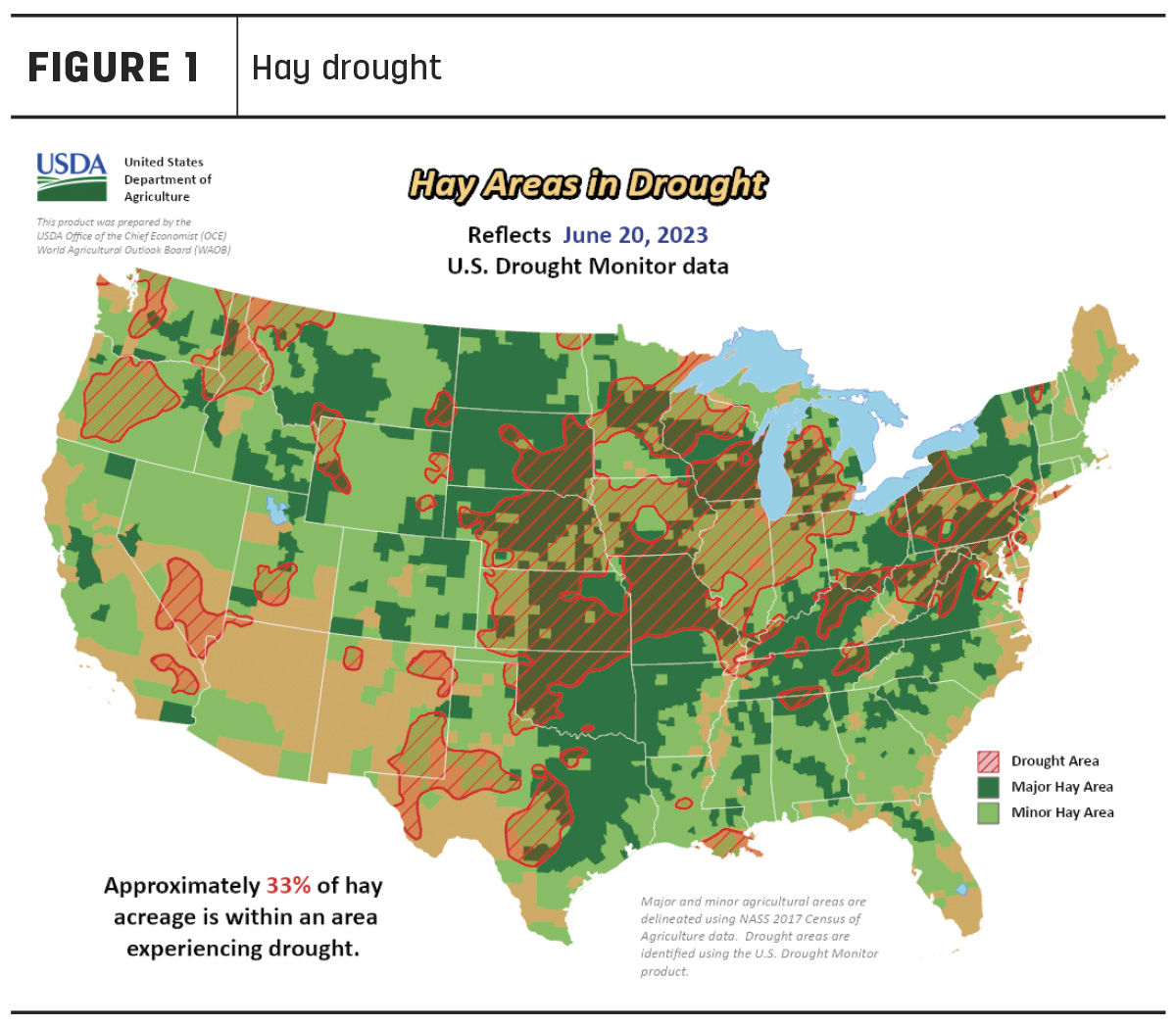

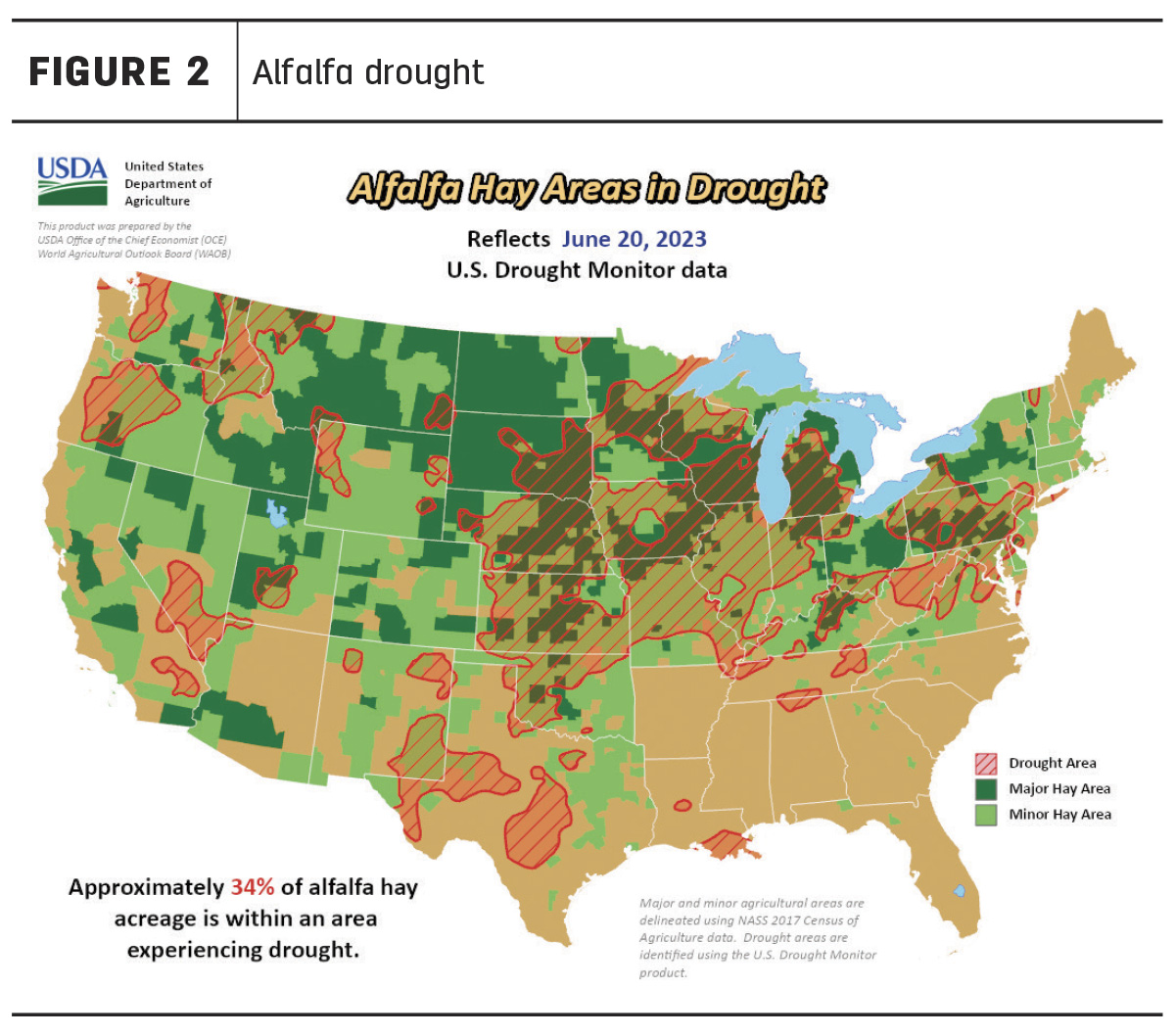

With reports of heavy rainfall in some parts of the country, overall U.S. Drought Monitor Maps indicate drought areas that are in drought to be abundant. As of June 20, approximately 33% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions, with 25% being reported the month prior. The area of alfalfa hay-producing acreage (Figure 2) under drought conditions increased to 34% from 26% the month prior.

A snapshot of hay prices

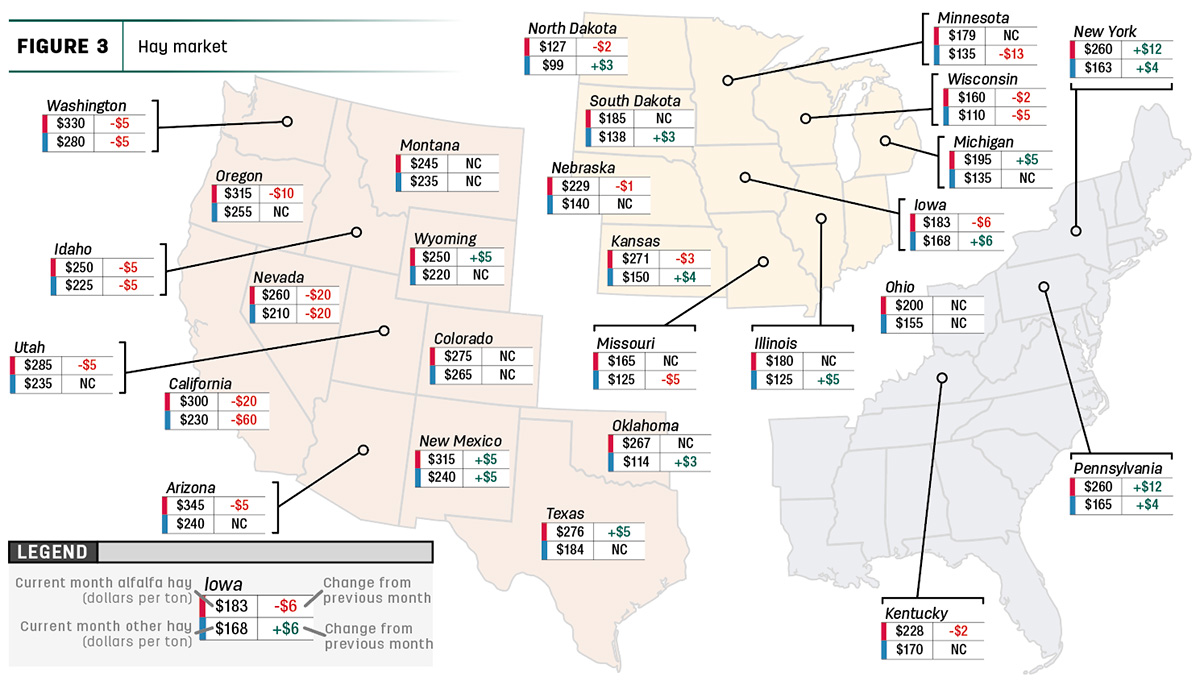

Price data for 27 major hay-producing states is mapped in Figure 3, illustrating the most recent monthly average price and one-month change. The lag in USDA price reports and price averaging across several quality grades of hay may not always capture current markets, so check individual market reports elsewhere in Progressive Forage.

Dairy hay

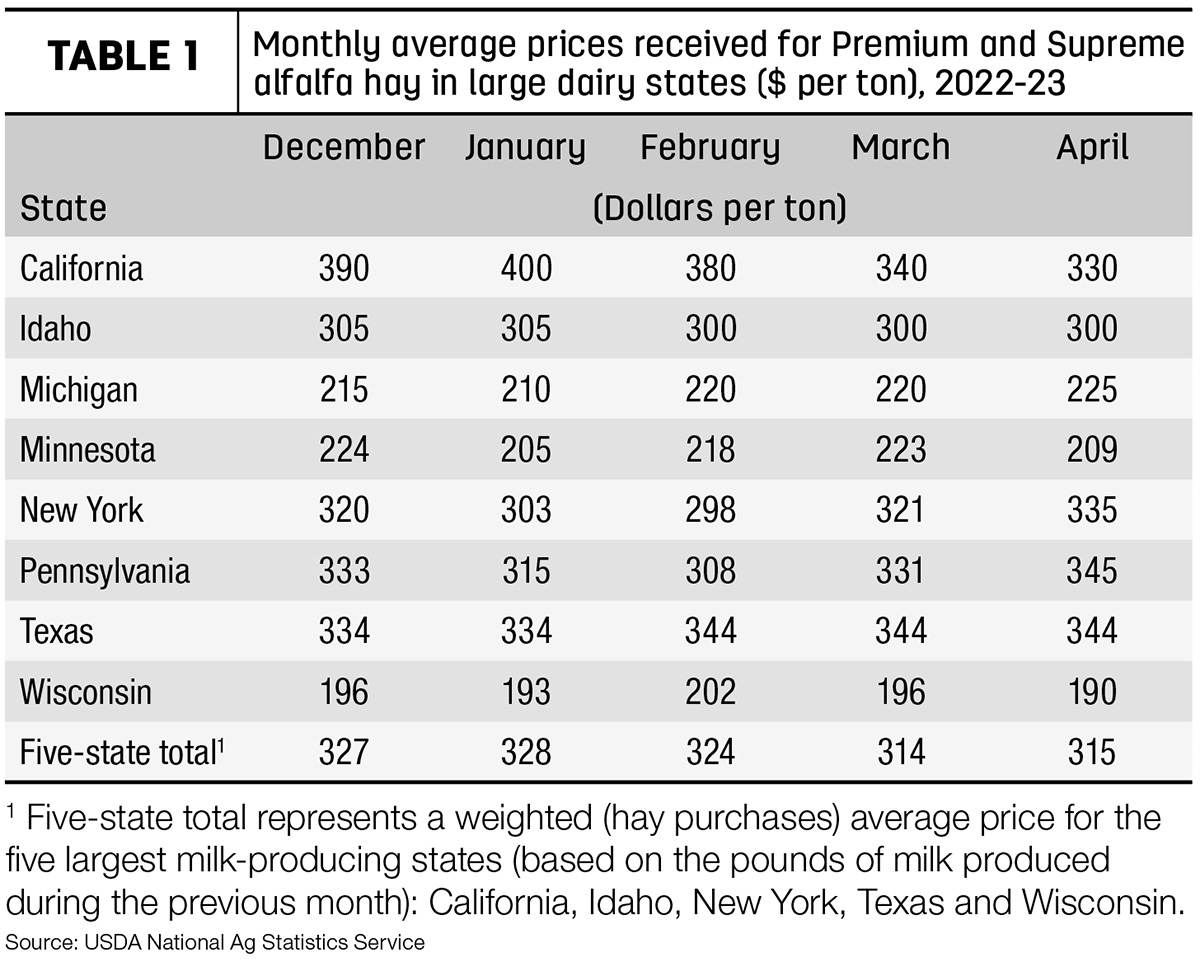

The top milk-producing states reported a price of $315 per ton of Premium and Supreme alfalfa hay in the month of May, a $1 increase from April of this year. The price is $44 higher than what was reported in April 2022 (Table 1).

Regional markets

- Midwest: In Nebraska, some buyers have been reluctant to pay the prices of last-year sales for first-cutting hay, even though producers would like the steady income stream. Large and small square bales being shipped out have been a reliable and heavily sought-out market. Some central and eastern areas have started their second cutting, while the western side of the state continues to struggle to get the first cutting out of the field due to rain.

In Kansas, prices remain steady with trade slow to moderate. Demand remains good overall. The market could indicate a slight softening to the market as producers continue to produce hay across all regions.

In South Dakota, alfalfa is a steadying market. The demand for new-crop hay is good while some dairy producers are resistant to price due to current milk prices. Second cutting has begun as rains are causing tonnage to be a bit light. Corn is showing great signs of distress due to drought in the driest regions.

In Missouri, harvest is still going along strong. The latest report says around 70% of hay is complete as of late June. Drought conditions are declining even more as 40% of the state is now listed as being in severe drought conditions. A few reports are saying that some producers already have a need to feed hay as the grass is nonexistent in the driest areas. Hay demand is high with lots of buyer interest and supply is light. Prices are steady to firm.

- East: In Alabama, hay prices remain steady with trade being moderate with light supply and demand still moderate.

In Pennsylvania, data is limited due to very light supply with buyer demand remaining moderate.

- Southwest: In California, in comparison to the last few weeks, trade and activity were slow. Demand for retail hay was light. Export and hay demand was slow. Some alfalfa was harvested for silage and dried for hay. Silage corn was reported to be sprayed for weeds across the state.

In New Mexico, compared to previous weeks, alfalfa hay is steady. Demand is good and trade is active. Second cutting has begun in the southern and eastern parts of the state while a few producers are beginning their third cutting. Some of the northern region remains in the first cutting.

In Oklahoma, limited demand is resulting in slow hay trade. Pricing is still uncertain in several parts of the state. Much of the state is struggling with getting hay cut and out of the field. Producers are still trying to rebuild their inventories from last year.

In Texas, hay prices remain mostly steady but prices are beginning to soften in some regions as pasture conditions improve. First cutting has been cut, but untimely rains are preventing some regions from harvesting the fields, causing the hay to be classified as commercial cow hay rather than a higher quality grade. The weather has been more cooperative for this cutting and allowed for higher-quality hay overall. A severe heat wave overtaking several portions of the state is putting production and grassland at risk for decreased production.

- Northwest: In the Columbia Basin, high-testing hay supply remains steady compared to earlier in the month. Non-testing hay market is running weaker. Despite some resistance noted on higher prices, retail hay demand remains steady. Trade demand is moderate to light with light hay demand.

In Montana, the hay market is fully steadying compared to earlier in the month. Demand from out-of-state buyers elevated demand as hay was shipped south to drier areas of the country. Most hay stores are low and producers are focusing on producing the next cutting of hay. Wet conditions have delayed the next cutting in some parts of the state. As contracts start being written, producers are reporting moderate demand.

In Idaho, compared to earlier this month, the kick-outs of old crops remain weak. Due to heavy rainfall, most of the trade area has been delaying harvest and creating overmature supplies. Demand from buyers is light as no hay is being tested due to weather conditions.

In Colorado, trade activity has been reported as very light on good demand. A few reported trades of horse-quality hay have taken place. New-crop hay continues to be priced by growers.

In Wyoming, in comparison to earlier in the month, alfalfa cubes and sun-cured alfalfa pellets are selling steady. The first cutting of alfalfa is still being delayed due to the rains in many parts of the state. Some hay has reportedly been chopped earlier and sent to the dairy or a feedlot. Others are still holding onto the mowing system and hoping for the best. The majority of fields are on average three weeks overdue on being baled, which will overall shorten the growing season for other cuttings.

Other things we are seeing

- Hay stocks on farms: All hay stored on U.S. farms as of May 1, 2023, totaled 14.5 million tons, down 13% from May 1, 2022. The May 1 hay stock level for the U.S. represents the second-lowest amount stored since records began in 1950. Disappearance from Dec. 1, 2022 – May 1, 2023, totaled 57.4 million tons, down 8% from the same period a year earlier.

- Dairy: U.S. milk production posted small growth in May, but even that was enough to overwhelm Midwestern cheese processing capacity and add to downward pricing pressures. Preliminary May 2023 U.S. cow numbers were estimated at 9.43 million head, up 13,000 from a year earlier but unchanged from April’s revised estimate. With the school year ending and fluid milk orders down, milk supplies were running high, especially in the Midwest where the spring flush has been extended with cooler temperatures. Surplus milk was being discounted between $4 and $11 per hundredweight below the Class III price as cheesemakers remained at or near processing capacity. Milk handlers had trouble finding homes for extra loads, forcing some milk dumping.

- Cattle: With generally improving pastures and lower expected feed costs this year, the demand for feeder calves is well supported. This demand is likely reflected in higher year-over-year cumulative feeder and stocker receipts in April and May published by the USDA Agricultural Marketing Service in the weekly report National Feeder and Stocker Cattle Summary.

- Fuel: Fuel prices remain steady across the board according to the U.S. Energy Information Administration (EIA). The U.S. retail price for regular-grade gasoline averaged $3.57 per gallon, a decrease of 0.006 cents from the week earlier, $1.39 lower than a year ago. The average U.S. retail diesel price was around $3.80 per gallon, which is down 0.014 cents from the previous week and $1.98 cheaper than June 2022.

- Trucking: Spot flatbed prices remained steady over the month of June, with a change in average price of 0.0%, according to the DAT Freight and Analytics trendline. Regionally, average spot prices per mile were: Southeast – $2.76, Midwest – $2.74, South – $2.76, Northeast – $2.51 and West – $2.31.