With the peak of summer behind us and the tempting cooler temperatures of fall approaching, the hay market is still driven by who is able to put up high-quality hay or not. While some parts of the country are still suffering from drought and the increased temperatures are causing crops to backfall, other parts of the country are struggling to put up hay that hasn’t been rained on. Take a closer look at what prices and conditions are in each region in the Progressive Forage Forage Market Insights column as of Aug. 8, 2023.

Moisture conditions decrease slightly

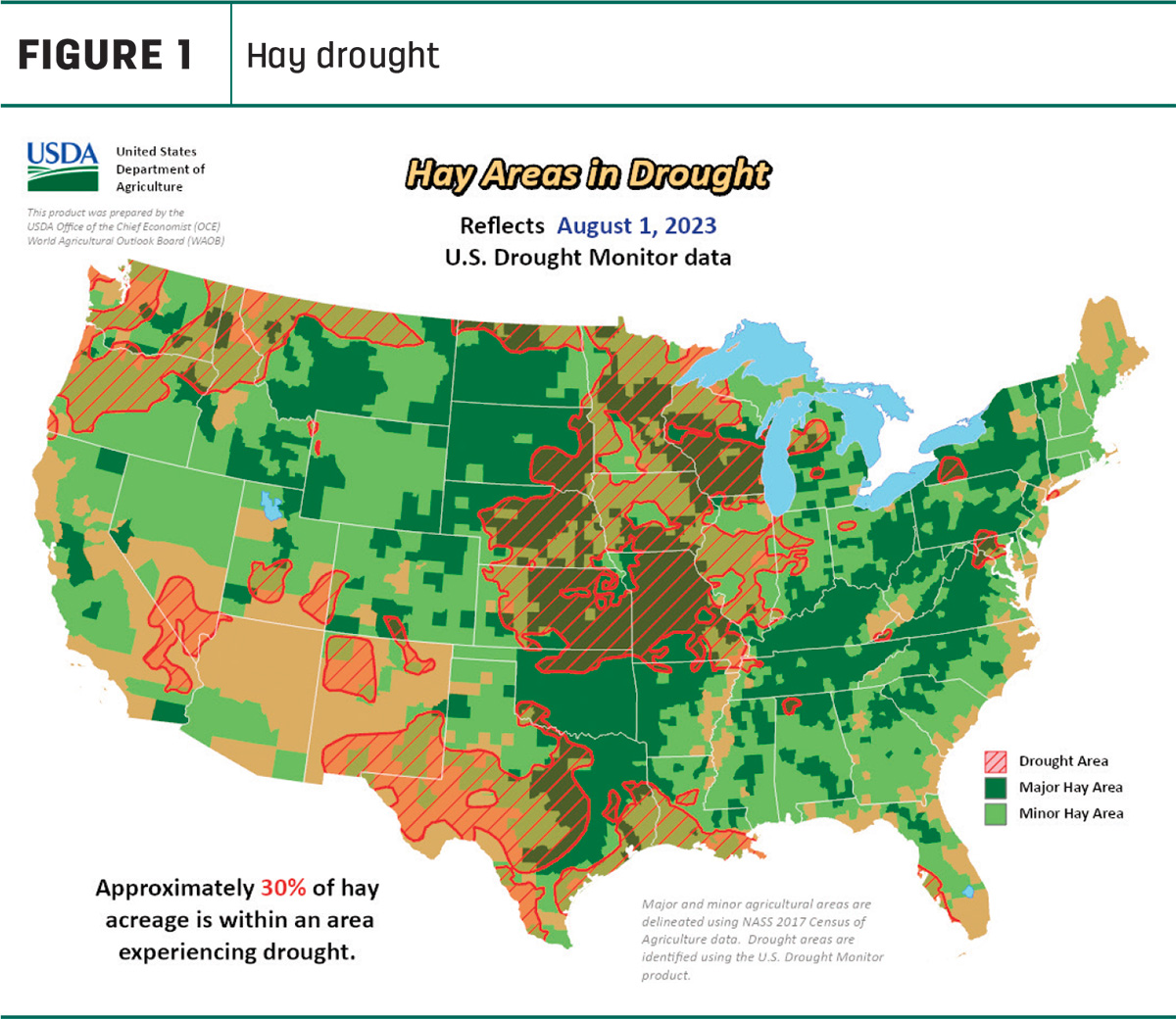

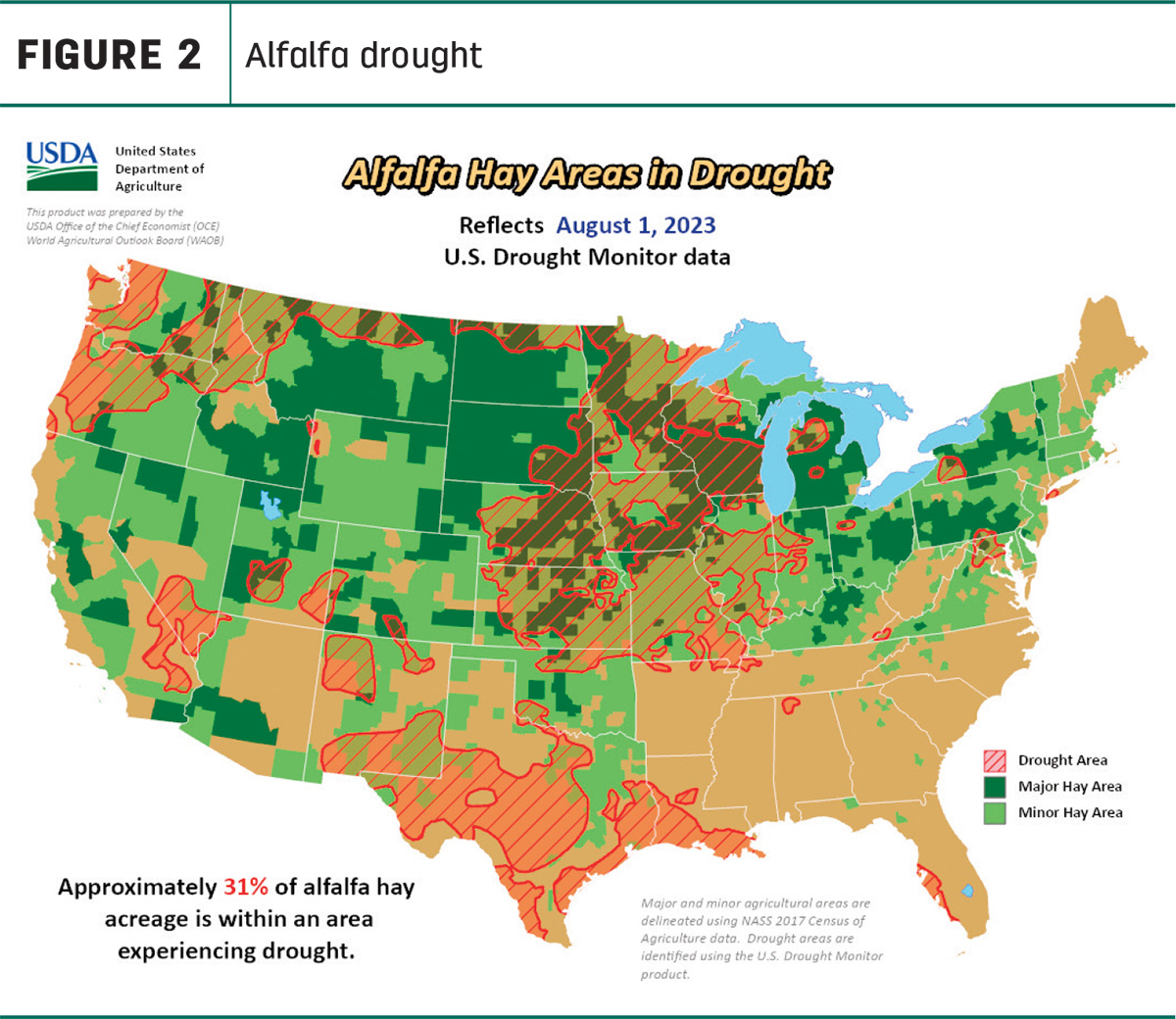

With reports of heavy rainfall in some parts of the country, overall U.S. Drought Monitor Maps indicate drought areas that are in drought to be prevalent still. As of Aug. 1, approximately 30% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions, with 33% being reported the month prior. The area of alfalfa hay-producing acreage (Figure 2) under drought conditions decreased to 31% from 34% the month prior.

A snapshot of hay prices

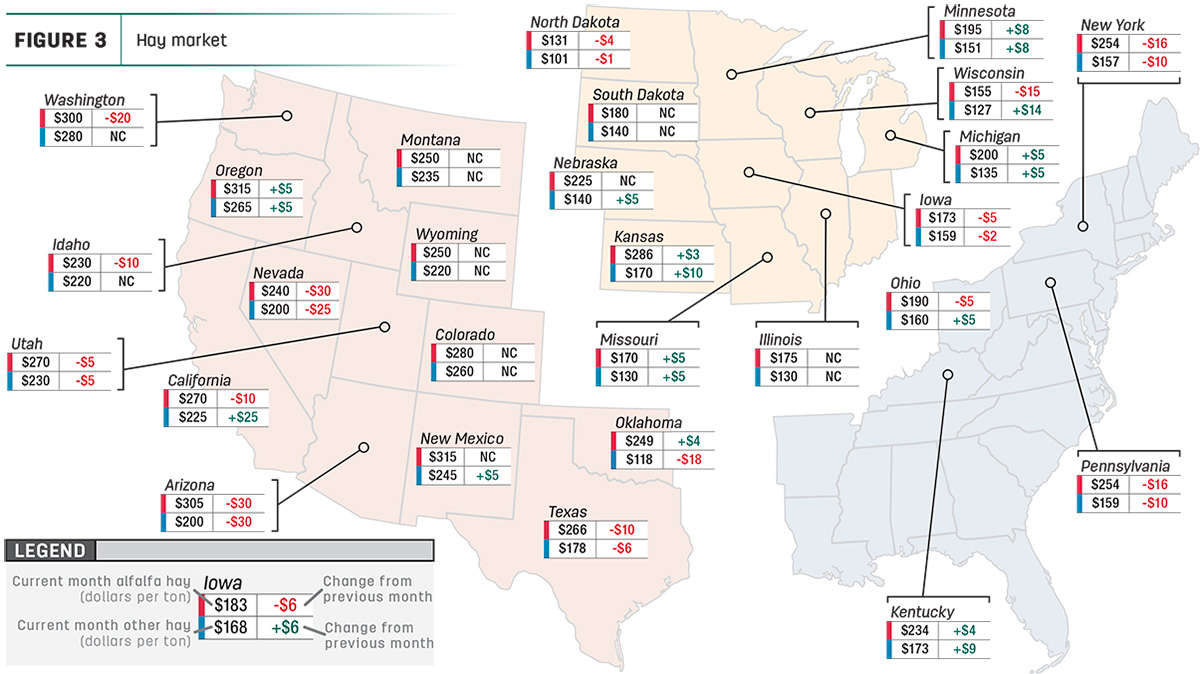

Price data for 27 major hay-producing states is mapped in Figure 3, illustrating the most recent monthly average price and one-month change. The lag in USDA price reports and price averaging across several quality grades of hay may not always capture current markets, so check individual market reports elsewhere in Progressive Forage.

Dairy hay

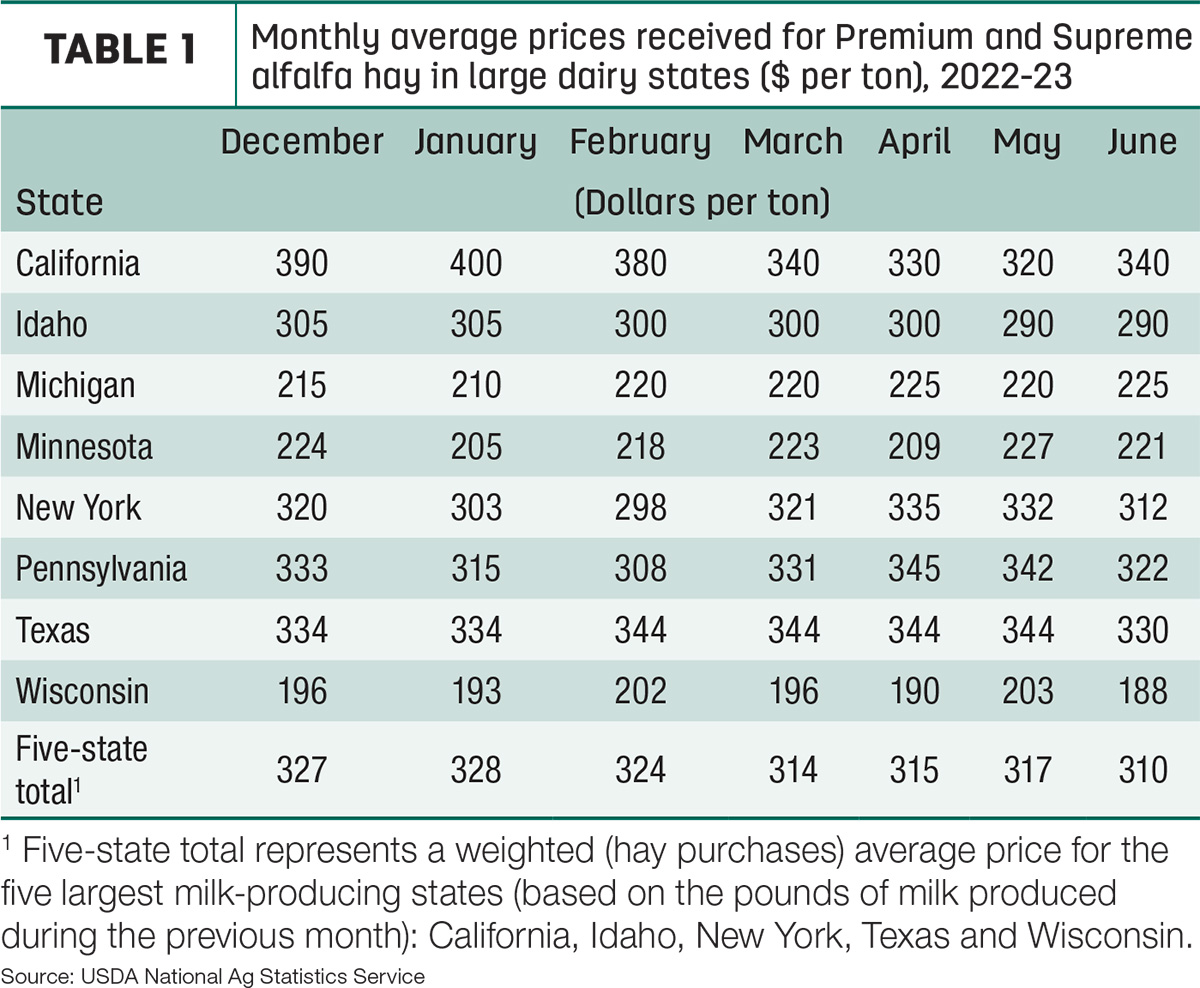

The top milk-producing states reported a price of $310 per ton of Premium and Supreme alfalfa hay in the month of June, a $7 decrease from May of this year. The price is $33 higher than what was reported in June 2022 (Table 1).

Regional markets

- Midwest: In Nebraska, bales of alfalfa sold steady but $10 lower than the previous week. Grass hay was sold unevenly steady while dehydrated alfalfa pellets sold steady. Rain showers continue across areas of the state to help with new growth but has also damaged several acres of hay that producers are unable to bale.

In Kansas, demand and trade activity remains slow while prices hold steady. Half the state is still boasting receiving the majority of the rainfall while the other half is severely lacking in moisture. Yields are light for those without rainfall and the crops are going backward.

In South Dakota, both alfalfa and grass hay are steady. Good demand remains for all quality and types of hay. Grass hay tonnage is being reduced due to drought conditions. Third-cutting alfalfa is proving to be a challenge with high humidity levels. Drought conditions have worsened as temperatures remain hot.

In Missouri, a large portion of the state received several inches of rain, and it has made a significant difference in conditions. Flooding became an issue as the banks have overrun, causing runoff. The majority of the state is visibly green and crops are growing again. Supply is light but prices are steady.

- East: In Alabama, hay prices remain steady with trade being moderate with supply and demand still moderate.

In Pennsylvania, alfalfa and grass mix is selling weak along with orchard and timothy. Wheat straw sold steady. Buyer demand remains moderate all around.

- Southwest: In California, trade and activity were moderate to good. Retail hay demand remains good. Dairy and export hay demand were moderate.

In New Mexico, alfalfa hay sold steadily. Most producers are finishing the third cutting and beginning the fourth, while less than 20% are finishing up the second cutting.

In Oklahoma, drought is beginning to set back into parts of the state. The second and third cuttings are producing just a quarter or half of what previous cuttings have yielded. Scattered rains are very much needed along with some cooler temperatures for relief. Trades are good while demand is moderate to light. Barns seem to be full of hay but demand is on the rise.

In Texas, hay prices are steady with $15 lower prices compared to last month in the west and the Panhandle. Pasture conditions are diminishing due to lack of rainfall and higher temperatures. Hay has begun moving into the state from surrounding states.

- Northwest: In the Columbia Basin, not enough reported sales for accurate trends to be reported. Exporters are still suffering losses on the remainder of the 2022 hay supply. Trade is slow with light to moderate demand for export hay and high for retail and high-testing hay.

In Montana, demand for local hay is light while out-of-state demand is the main driver in the market. Few large sales have been reported in comparison to previous weeks, and producers and buyers continue to barter on price.

In Idaho, not enough testing of domestic hay was reported for accurate price trends. Defective hay remains to be selling weak. Rainfall is beginning to take an impact in the quality of overall forages being produced. Trade is moderate with light to moderate demand.

In Colorado, both trade activity and demand have softened and hay trades are slow. Areas that have received heavy rainfall are struggling to put up hay that will test well. All producers seem to be struggling to put up hay without any rain on it.

In Wyoming, all forage products seem to be selling unevenly steady. Overall demand is light and spotty rain showers with the chance of torrential downpours have interrupted production in a large majority of the state.

Other things we are seeing

- USDA report updates hay acreage estimates: The USDA’s Acreage report, released June 30, estimates planting data from a National Ag Statistics Service (NASS) survey during the first two weeks of June. Producers intend to harvest 52 million acres of all hay in 2023, up 5% from 2022. Alfalfa harvested acreage is expected to be 15.7 million acres, up 5% from 2022. All other hay (excluding alfalfa) is expected to be up 5% from last year, at 36.3 million acres.

- Dairy: Like recent months, checks for July milk marketings for many dairy farmers will reflect weak protein and Class III milk prices. And the wide price spread between Class III-IV milk prices means Class IV depooling will remain heavy. It won't ease the financial pain, but August milk prices should start to improve. Based on FMMO advanced prices and current futures prices, milk prices should start to recover somewhat in August, although it will be a struggle. Already announced, the August advanced Class I base price is $16.62 per hundredweight (cwt), down 70 cents from July and $8.51 less than August 2022. It’s the lowest level since September 2021.

- Cattle: As of July 1, beef cow inventories were down 3% from a year ago at 29.4 million head. With the decline in cow numbers, the 2023 calf crop is expected to be 33.8 million head, down 2% from last year. The estimated number of calves born in the first half of 2023 is 24.8 million, down 2% compared to the first half of 2022. Since January, slaughter data has indicated a 12% decline in beef cow slaughter. This is likely a combination of improving pasture conditions, sufficient reductions in animal units per acre on poorer pastures and the prospect of improved profitability from selling calves.

- Fuel: Fuel prices remain steady across the board according to the U.S. Energy Information Administration (EIA). The U.S. retail price for regular-grade gasoline averaged $3.82 per gallon, an increase of 0.007 cents from the week earlier, 21 cents lower than a year ago. The average U.S. retail diesel price was around $4.23 per gallon, which is down 0.11 cents from the previous week and 75 cents cheaper than July 2022.

- Trucking: Spot flatbed prices ticked up over the month of July, with a change in average price of 0.2%, according to the DAT Freight and Analytics trendline. Regionally, average spot prices per mile were: Southeast – $2.61, Midwest – $2.64, South – $2.54, Northeast – $2.46 and West – $2.28.