Inflated dairy commodity prices fueled strong revenues for the world’s largest dairy companies in 2022, but that was countered by surging costs and unprecedented milk prices, according to an annual international report from Rabobank.

Rabobank’s yearly listing of the “Global Dairy Top 20” companies was released in late August, highlighting revenue performance of the world’s dairy industry leaders in 2022. Based on financial data in U.S. dollars, the combined sales of the world's 20 largest dairy companies were up 7.4% from the year before. That followed 2021’s increase of 9.3%. (Read: Rabobank: Dairy’s ‘Top 20’ highlights robust recovery)

Overall, year-on-year average price gains in butter, cheese, milk powders and other dairy products set the stage for double-digit sales growth in local currencies in 2022. At the same time, lower-than-anticipated milk production growth in the main exporting regions and decent domestic demand contributed to an overall tight dairy market with limited exportable surpluses during most of the year.

“In the end, most turnover gains were absorbed by exploding costs, leaving little left on the companies’ bottom lines,” explained Richard Scheper, dairy analyst at Rabobank. “Many dairy companies paid record-high average farmgate milk prices to offset large farm input costs.”

Rising energy costs and the availability of natural gas – especially in Europe – were the largest concerns for energy-intensive dairy processing. Costs for other components, such as logistics, packaging materials and labor, also escalated in 2022.

Top 20 rankings

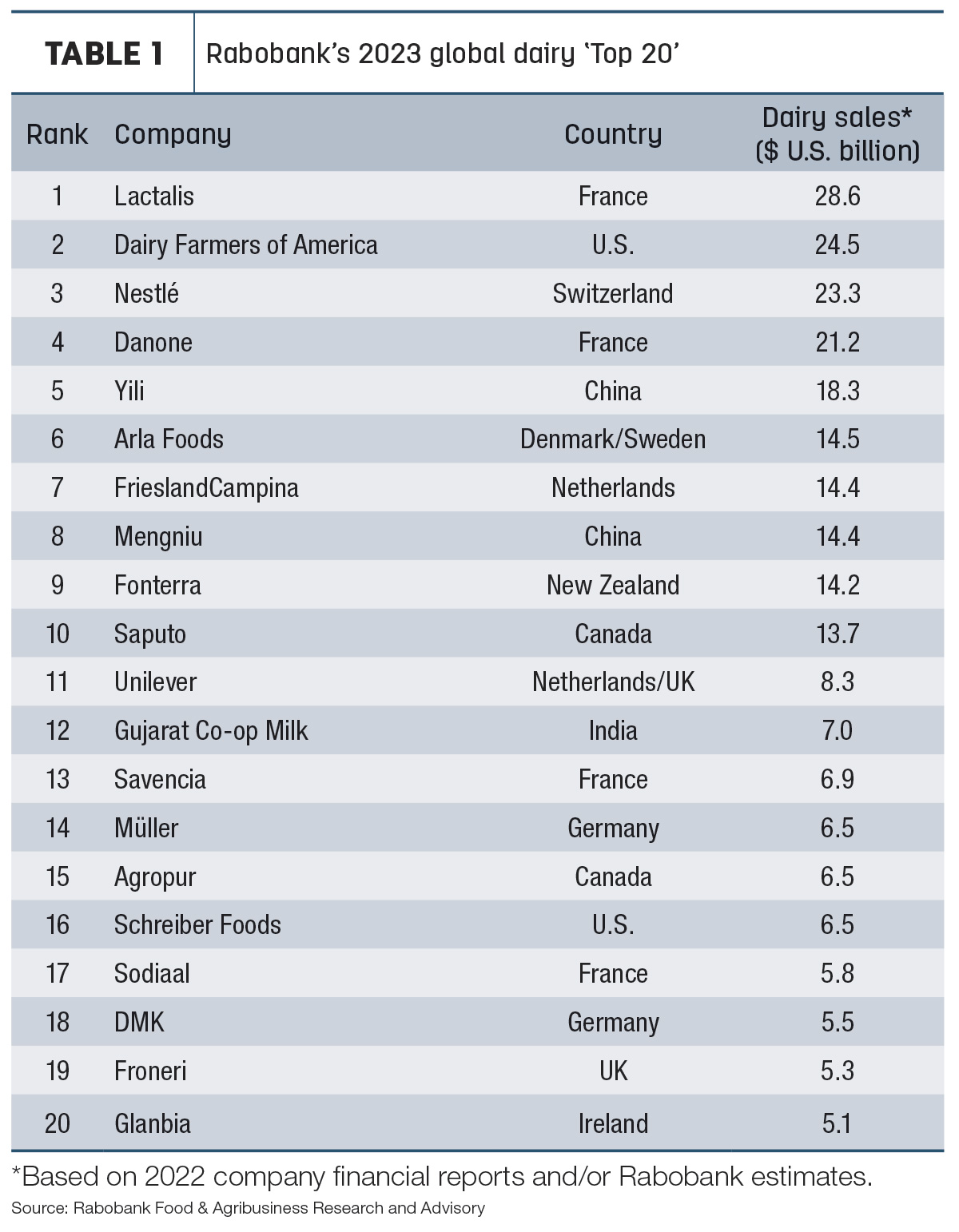

Among the top 20 spots, European companies increased their hold by one, to 12, with companies in the U.S., China and Canada holding two spots each (Table 1). Companies in New Zealand, Japan and India rounded out the list.

Only five companies kept the same positions as last year, indicating a reshuffle along the entire list. Lactalis managed to hold its top spot, while Dairy Farmers of America (DFA) moved up to second, pushing Nestlé into third.

Rankings impacted by exchange rates

Currency exchange rates had an impact on rankings. The U.S. and Canadian dollars strengthened against many other currencies, including the euro.

“For non-U.S.-based dairy companies, turnover gains in local currencies were partly or even largely offset by the stronger U.S. dollar, giving rise to position changes along the entire list and contributing to the entrance of Ireland-based Glanbia,” Scheper said. The majority of Glanbia’s revenues are derived from sales in the U.S., and the company recently announced that it will switch to reporting in U.S. dollars instead of in euros in the near future.

The stronger Canadian dollar helped Canada-based Saputo (10th) solidify its position and bumped Agropur up one spot to 15. Both companies have considerable sales volumes in the U.S., giving them a competitive advantage over the companies on the list reporting in euros.

Foreign exchange developments in 2022 were particularly unfavorable for dairy companies reporting in New Zealand dollars, renminbi and yen, contributing to New Zealand’s Fonterra dropping three spots; China’s Yili and Mengniu losing sales gains in U.S. dollar terms; and Japan-based Meiji, a long-standing top 20 company, exiting the list.

Merger and acquisition activity for these 20 market leaders in 2022 was nearly on par with the prior year. A slowdown in merger and acquisition activity was noted in the second half of the year, which continued into the first half of 2023.

Other highlights of the report indicate the largest dairy companies continue to increase their presence in the dairy alternative market, although it still represents a small share of revenue.

Looking ahead, Rabobank expects weakening dairy and retail prices will make 2023 a challenging year in terms of sales and profitability for some companies in the rankings.