Editor's update: The USDA’s Farm Service Agency (FSA) has authorized an expedited payment process and is allowing staff to work overtime to make sure producers receive farm program payments prior to a potential government shutdown. Program priorities include Dairy Margin Coverage (DMC) program indemnity payments.

In a notice to state and county FSA office on Sept. 28, FSA Administrator Zach Ducheneaux directed staff to focus on payment distribution through DMC and other USDA programs, including the Organic Dairy Marketing Assistance Program (ODMAP), Milk Loss Program (MLP), Emergency Relief Program (ERP) and Emergency Livestock Relief Program (ELRP).

Factors used to calculate August DMC margin and indemnity payment levels will are included in the USDA’s monthly Ag Prices report, to be release at 2 p.m. (Central time) on Sept. 29. FSA staff in county and state offices are authorized to work overtime on Friday evening, Sept. 29, until 1 p.m. (Central time) on Saturday, Sept. 30, to prepare payments requiring certification.

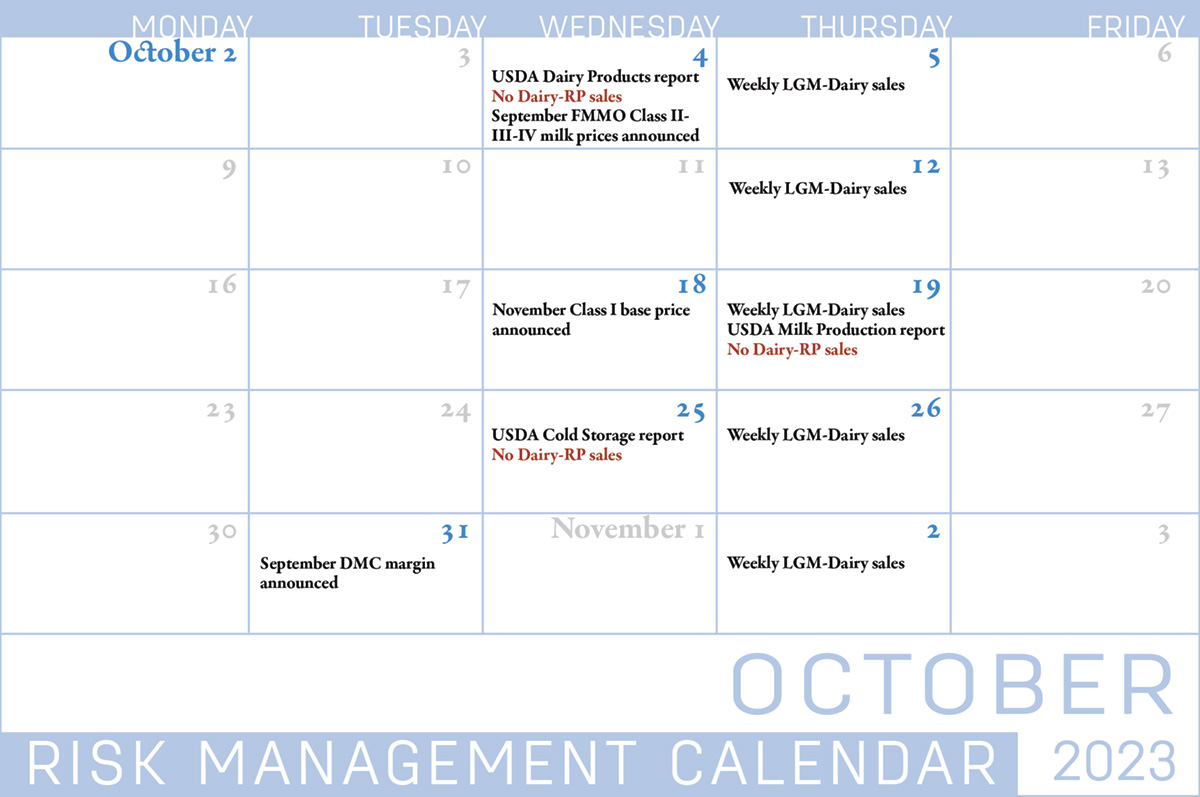

With a federal government shutdown possible, October’s dairy risk management calendar has the potential to be scarier than Halloween. Depending on the depth and length of a shutdown, dairy producers participating in the DMC, Dairy Revenue Protection (Dairy-RP) and Livestock Gross Margin for Dairy (LGM-Dairy) programs could be negatively impacted.

With a new fiscal year starting on Oct. 1, a shutdown enacted at the end of this week could affect all federal activities covered by discretionary appropriations. Congress has so far enacted none of the 12 appropriations bills setting discretionary spending levels.

Mandatory spending generally continues during a shutdown, but services associated with mandatory programs may be diminished. According to a fact sheet from the American Enterprise Institute, the Federal Crop Insurance Program is covered under mandatory spending, but the FSA and Risk Management Agency (RMA) fall under discretionary spending, as does USDA day-to-day operations.

Progressive Dairy inquiries to the USDA regarding DMC payments were directed to the White House Office of Management and Budget, which has posted contingency plans for various agencies and departments on its website.

In the event of the shutdown, each federal department and agency develops its own action plan, which includes information on employee furloughs and identifies which activities would come to a halt. The USDA updated its contingency plan in 2020.

As of Progressive Dairy’s deadline, the certainty of distribution of dairy risk management indemnity payments and the availability of producers to purchase future coverage remained in question.

With less than a week until a potential shutdown, Lucas Sjostrom, executive director of the Minnesota Milk Producers Association and part of the government affairs team with Edge Dairy Farmer Cooperative, urged dairy producers to prepare now.

“For the time being, we recommend you prioritize anything you need from your local FSA office or private insurance agents as soon as possible, including submitting any necessary paperwork, loan information, risk management selections, etc. We also encourage you to keep detailed records for the duration of a potential shutdown,” Sjostrom said.

There are also questions on whether the ongoing FMMO modernization hearing continues. Watch Progressive Dairy website for updates.

Market volatility

Outside of administration of government programs, cash cheese and butter prices and Class III-IV milk futures prices continue to bounce, providing both tricks and treats. That movement has the potential to impact Class III-IV milk prices, Federal Milk Marketing Order (FMMO) pooling and uniform prices and the Class I mover.

If a government shutdown is circumvented, here’s Progressive Dairy's monthly update on risk management tools available through the USDA, as well as important dates and other information impacting your milk check.

DMC program

The August 2023 DMC margin and indemnity payments will be announced on Sept. 29, with September data released on Oct. 31. August DMC numbers are expected to improve from July’s dismal picture, with a recovery in milk prices more than offsetting a slight increase in projected feed costs.

As of Sept. 22, the DMC decision tool forecast the August margin at $6.41 per hundredweight (cwt) and the September margin at $8.15 per cwt.

The July DMC margin was just $3.52 per cwt, below the program’s “catastrophic” floor of $4 per cwt for a second straight month and the lowest level since inception of the DMC program and its predecessor, MPP-Dairy.

With the extremely low milk-feed income margin in July, DMC indemnity payments distributed through the USDA’s FSA continued to mount. Through Sept. 5, DMC indemnity payments for the first seven months of 2023 had reached nearly $1.13 billion. (Read: Year-to-date 2023 DMC payments have topped $1.1 billion)

Dairy-RP

Producers managing risk through Dairy-RP are eligible to cover revenue from the first quarter of 2024 (January-March) through the first quarter of 2025. Dairy-RP quarterly endorsements are available for sale until about the 15th of the month preceding the quarter to be covered. That means coverage availability for the first quarter of 2024 closes on Dec. 15.

Dairy-RP coverage cannot be purchased on days when major USDA dairy reports that could impact markets, including Milk Production, Cold Storage and Dairy Product reports (see Calendar). Dairy-RP is also not available on days when applicable futures contracts move limit-up or limit-down, or on days when Chicago Mercantile Exchange (CME) trading is closed due to holidays.

The market changes daily and Dairy-RP endorsements must be purchased between the CME market closing and the next CME opening.

In August, the RMA revised how Class III-IV actual prices are calculated under Dairy-RP. The change is effective for the 2024 crop year for all endorsements that have an effective date on or after Sept. 16, 2023, and for the 2025 and succeeding crop years. Under that change, Class III and Class IV actual prices are sourced from the USDA Ag Marketing Service’s Announcement of Class and Component Prices report. The change is due to potential impacts to “make allowances” under consideration in the FMMO modernization hearing.

“We expected that dairy futures prices will soon start pricing in anticipated changes in make allowances,” said Marin Bozic, president of Bozic LLC. “As such, actual Class III and IV prices should not be based on make allowances that were in place when the endorsement was purchased, but on make allowances that were in force when the endorsement was settled. This change implements such an approach. We will publish as actual DRP prices exactly what AMS publishes, averaged to a quarter.”

LGM-Dairy

LGM-Dairy is another subsidized margin insurance program administered by the USDA’s RMA.

LGM-Dairy provides protection when feed costs rise or milk prices drop and can be tailored to any size farm. LGM-Dairy uses futures prices for corn, soybean meal and milk to determine the expected gross margin and the actual gross margin. LGM‑Dairy is similar to buying both a call option to limit higher feed costs and a put option to set a floor on milk prices.

Coverage can be purchased on expected milk marketings over a rolling 11-month insurance period. For example, the coverage period available during the final week of September contains the months of November 2023 through September 2024.

Sales periods for the LGM-Dairy program are open on a weekly basis. Unlike Dairy-RP, LGM-Dairy is available even if a sales period falls on the day of a USDA report. Premium payments are due at the end of the insurance period.

August milk production

U.S. milk production fell below year-ago output for a second consecutive month, according to the USDA’s August Milk Production report, released Sept. 18. Much of the decline can be attributed to three large dairy states in the Southwest. (Read: Southwest pulls August U.S. milk production lower)

The U.S. dairy herd is now the smallest since February 2022, although the decline that started this spring has stopped. Preliminary August 2023 U.S. cow numbers were estimated at 9.39 million head, down 16,000 from a year earlier but unchanged from July’s revised estimate. Among the 24 major dairy states, August 2023 cow numbers were estimated at 8.912 million, down 15,000 from August 2022 but up 1,000 head from July 2023.

Contributing to the smaller milking herd, about 2.15 million head of dairy cull cows were marketed through U.S. slaughter plants as of Sept. 2, up about 110,600 from the same period in 2022.

FMMO data

Administrators of the 11 FMMOs reported August 2023 prices and pooling data, Sept. 11-14. Looking back at the 2023 version of “what we did last summer,” one thing is clear: Class IV milk didn’t jump into pools. Meanwhile, more Class I (fluid) milk was headed back to school after a seasonal recess. (Read: Pools and schools: A look at August FMMO numbers)

WASDE outlook

The USDA’s monthly World Ag Supply and Demand Estimates (WASDE) report was released Sept. 12. Milk production forecasts for 2023 and 2024 were again reduced, with cow numbers lowered through the end of 2023 and the first half of 2024. Output per cow was reduced for 2023 but unchanged for 2024. The slowdown in production growth added support for an improving price outlook.

In addition to U.S. production, low milk prices in most key global dairy regions have slowed milk production growth in recent months, pressuring supplies closer to tepid demand growth. While the delicate balance of global milk supply and demand persists, there are signs of optimism for the remainder of 2023 and into 2024, according to Rabobank’s Global Dairy Sector Team. (Read: USDA cuts 2023-24 milk production estimates, improving outlook for prices)

Check the Progressive Dairy website for updates affecting milk prices as they become available.