Winter weather is ahead and most of the harvest season is behind us; the 2023 production year is coming to a close, with final prices taking shape and a better idea of what forage needs will look like over the winter. Take a closer look at prices and conditions in each region in the Progressive Forage Forage Market Insights column as of Oct. 10, 2023.

Moisture conditions continue to decrease

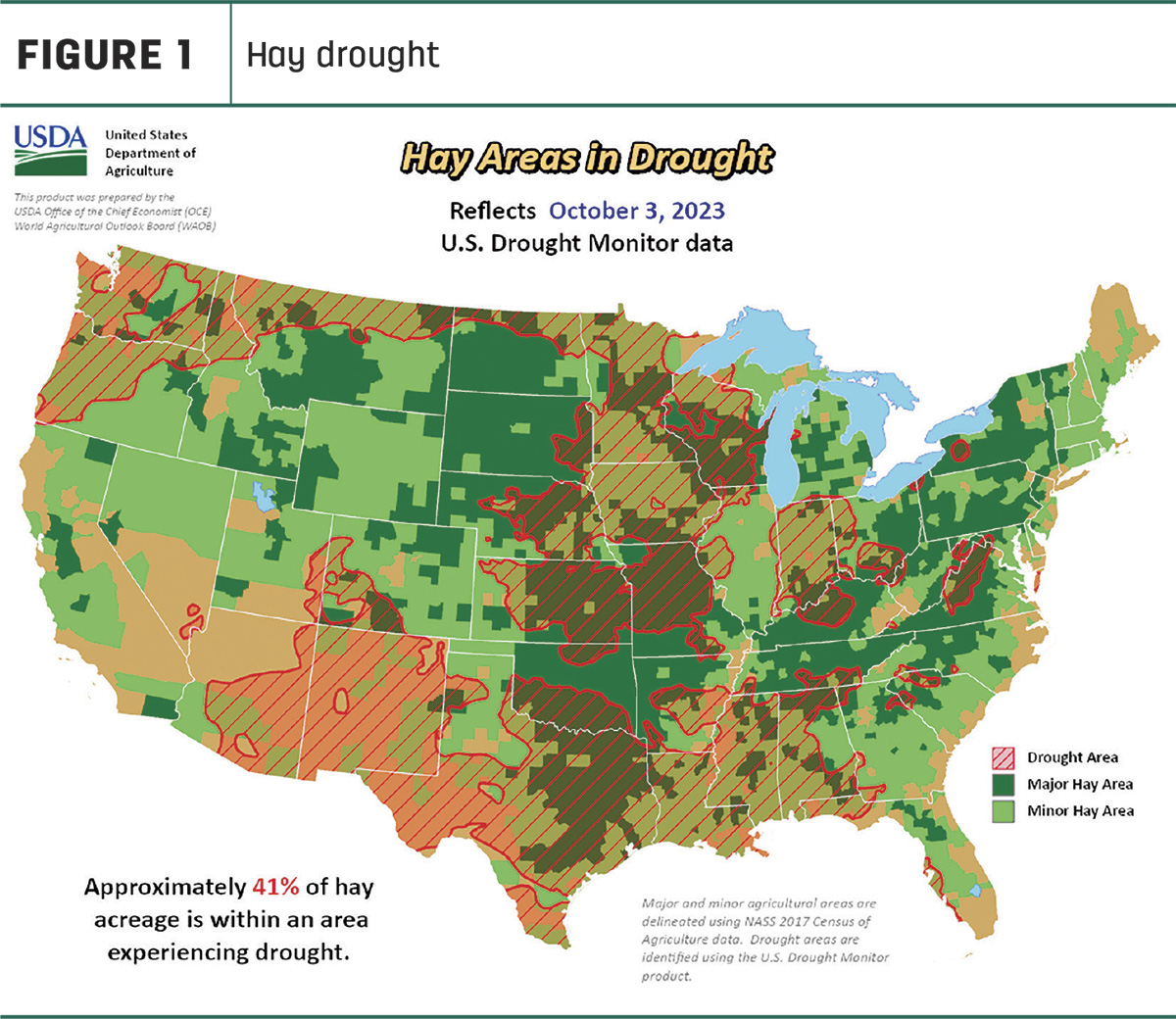

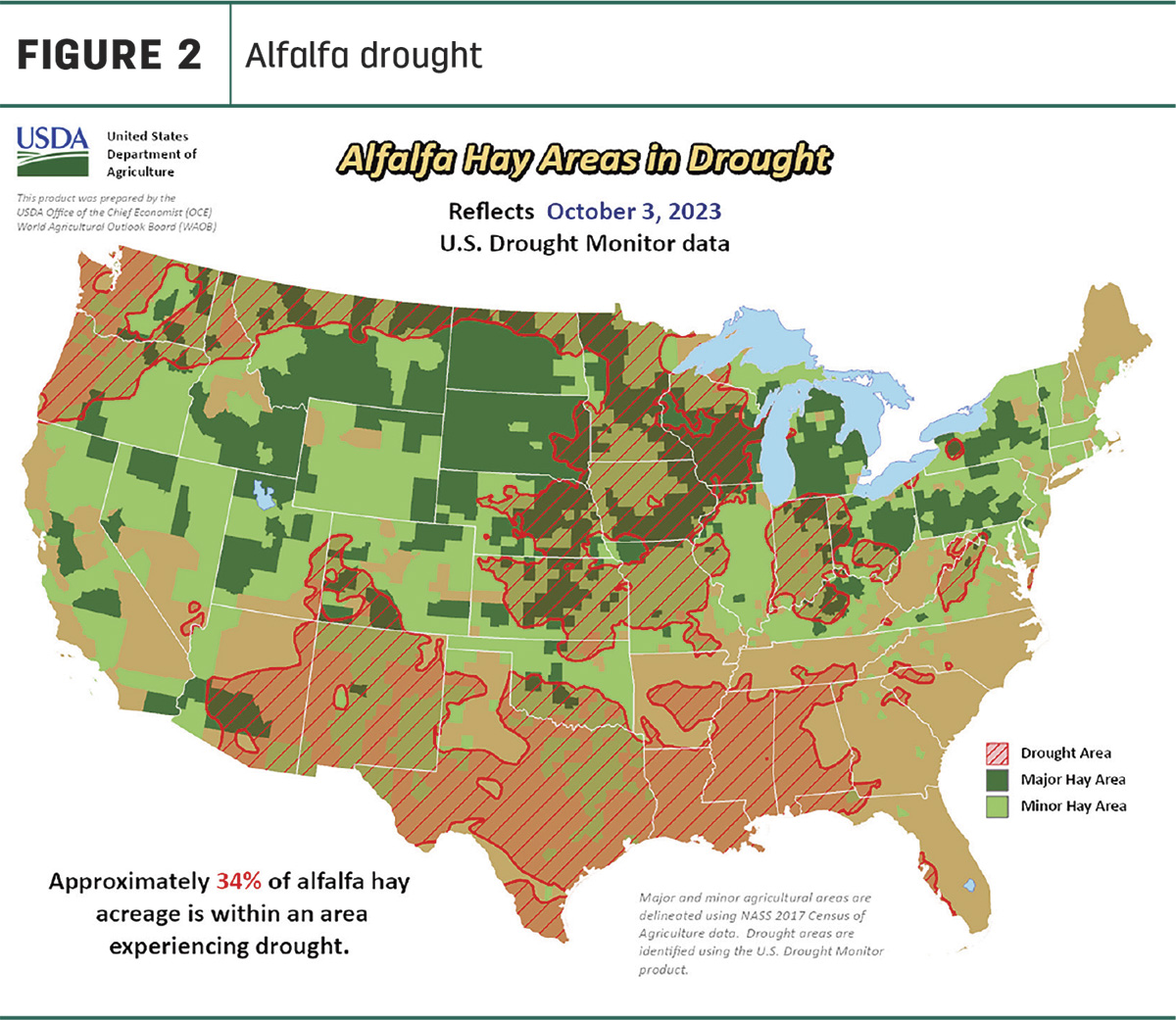

With reports of heavy rainfall in some parts of the country, overall U.S. Drought Monitor Maps indicate drought areas that are in drought to be prevalent still. As of Oct. 3, approximately 41% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions, with 34% being reported the month prior. The area of alfalfa hay-producing acreage (Figure 2) under drought conditions increased slightly to 34% from 33% the month prior.

A snapshot of hay prices

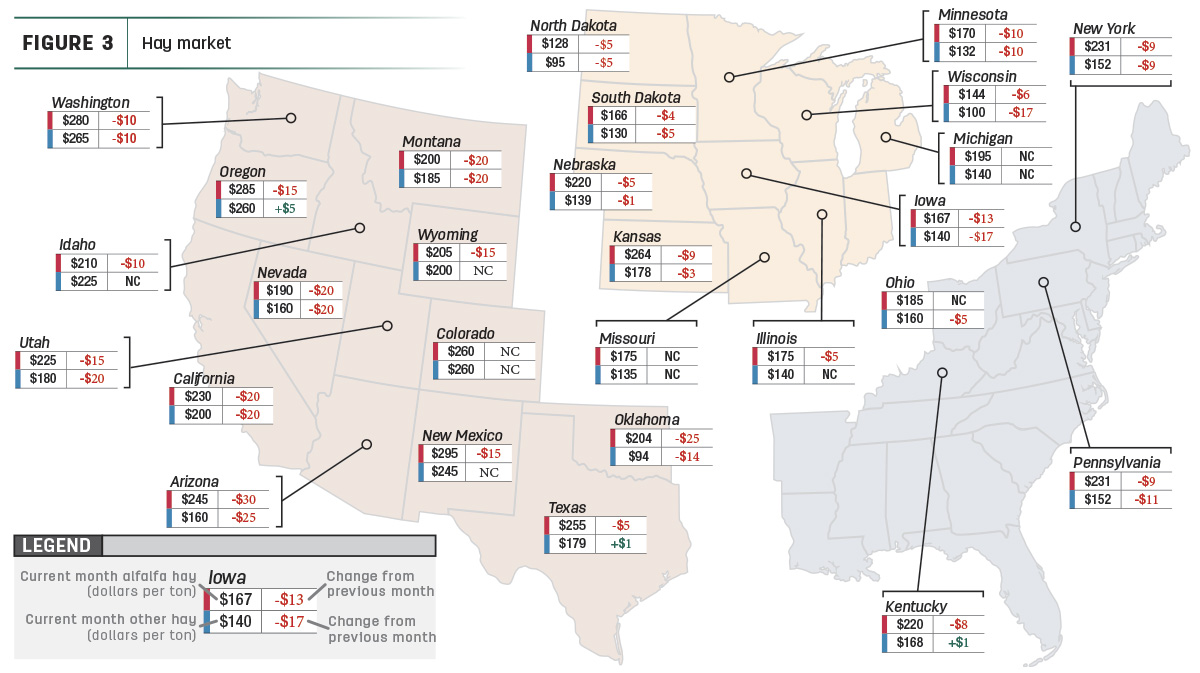

Price data for 27 major hay-producing states is mapped in Figure 3, illustrating the most recent monthly average price and one-month change. The lag in USDA price reports and price averaging across several quality grades of hay may not always capture current markets, so check individual market reports elsewhere in Progressive Forage.

Exports

With August bringing the highest monthly total so far this year, the export market is still less than desirable for those looking to sell. According to the U.S. Census Bureau, all-hay exports from the U.S. totaled 277,213 metric tons (MT), down 22% from last year, and bringing the total to 1,981,510 MT through August, down 30% from this point last year.

Dairy hay

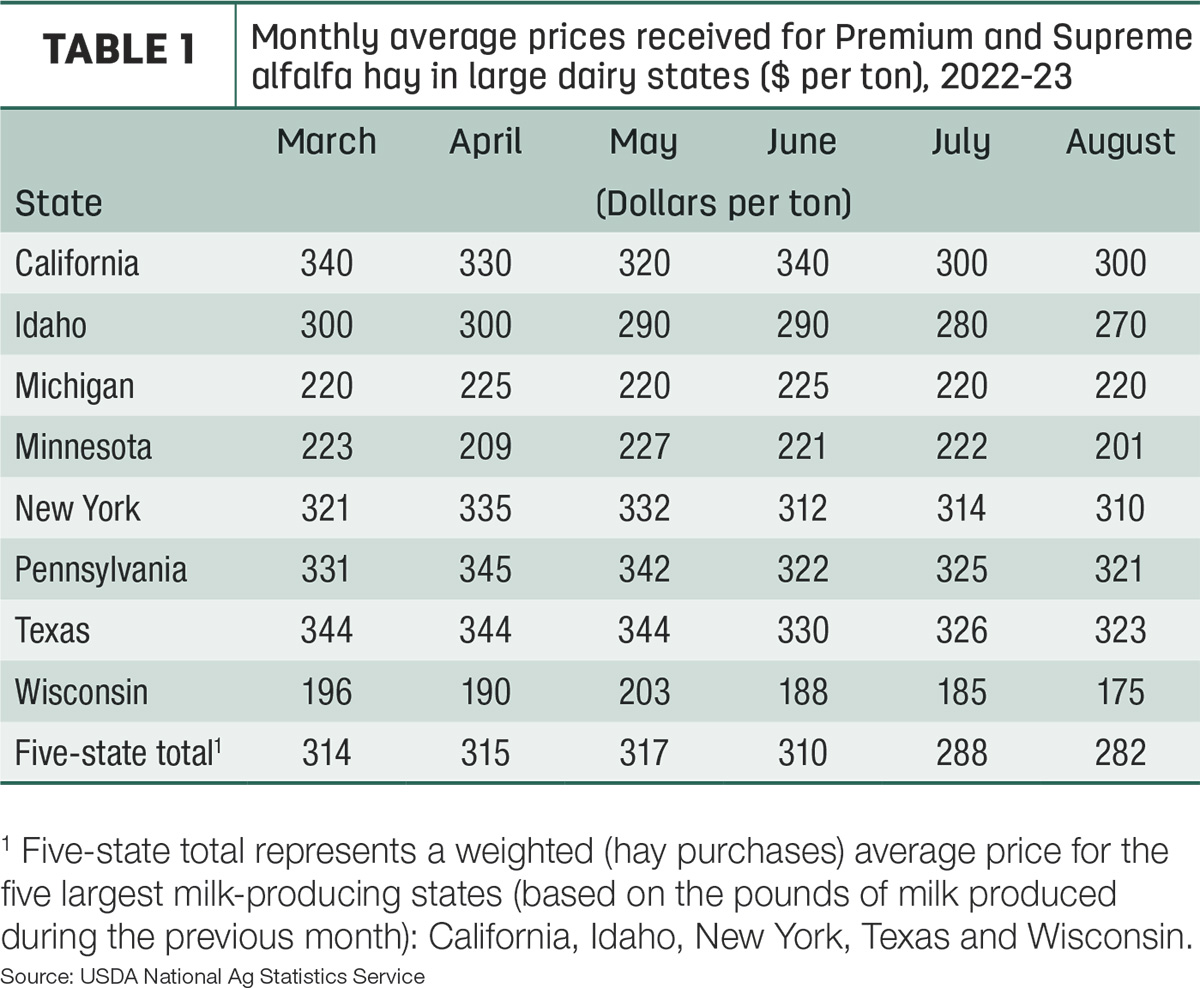

The top milk-producing states reported a price of $282 per ton of Premium and Supreme alfalfa hay in the month of August, a $6 decrease from July of this year. The price is $61 lower than what was reported in August 2022 (Table 1).

Regional markets

- Midwest: In Nebraska, hay sales are holding steady. Demand was light to moderate in most areas. With harvest being the main priority, most stock owners have put buying hay on the back burner. After a mostly favorable silage harvest, it is predicted that silage and similar roughage sources will take the place of dry hay in rations this year. Depending on the weather, it is likely there will be thousands of cornstalk bales put up in the next few weeks.

In Kansas, prices remain steady while demand and trade activity have stayed steady. Trades specifically for alfalfa have picked up a bit in the southwest and south-central regions, but the vast majority of feeding options has limited the price for it to be traded at, while many producers are reported to be finishing corn harvest and moving on to other row crops. Yields of all crops have been reported to be down.

In South Dakota, alfalfa hay sales are being reported as steady. While local hay buyers are creating moderate demand, the most demand is coming from out-of-state dairies in need of high-testing alfalfa. The demand for grass hay is on the rise as calves will soon begin arriving at the feedbunk. Corn harvest has started and is off to a successful start.

In Missouri, the hay business is moving forward slowly with not much changed. Corn harvest is approaching the halfway point and producers who have finished are moving on to cutting beans. Over 85% of the state is now showing up on the drought monitor. Some hay is still being baled with lots of hay being moved around on the roads. Prices are holding steady while demand is moderate.

- East: In Alabama, trade is moderate with good supply and moderate demand. Steady prices all around are reported.

In Pennsylvania, alfalfa sold steady on a light comparison, while alfalfa and grass mix sold strong on the same comparison. Prairie and meadow grass sold steady along with wheat straw. Buyer demand was moderate to match the moderate supply.

- Southwest: In California, trade and activity were light. Moderate demand for retail hay was reported. Demand for dairy hay was also moderate while demand for export hay remains very light. Matured corn was chopped for silage and alfalfa was harvested for hay and silage. Immediately after harvest, fields were fertilized and disced in preparation for winter crops.

In New Mexico, alfalfa hay sold steadily with active trades and good demand reported. The state is complete with fourth cutting while the majority are in the fifth or even sixth cutting. Some parts of the state have received scattered showers. Monsoon season was drier than normal, and much of the state is still desperate for moisture. Hay and roughage supplies are in short supply and stock water supplies are very short.

In Oklahoma, hay sold steady or even slowly with very little movement across the state. Even though some rainfall was received, much of the state is still desperate for widespread rain before the fall season.

In Texas, hay prices are holding steady across the state with quality and freight prices creating a wide disparity in price. Buyer demand is good as range conditions continue to deteriorate due to lack of moisture.

- Northwest: In the Columbia Basin, all grades of hay are steady with some producers looking for a fifth cutting before the season ends. Trade remains slow with light to moderate demand.

In Montana, hay sold generally steady with sales being light as producers are busy with harvest or gathering cattle off of mountain pasture. Hay demand is light locally and mostly moderate for hay going out of state. Demand for straw is moderate while heavy supplies continue to be reported.

In Idaho, domestic alfalfa is holding steady. The third cutting has yet to be harvested in most of the trade area. Trade is slow with good demand for high-testing supplies, and defective supplies are experiencing light to moderate demand.

In Colorado, both trade activity and demand are light. Silage harvest is in full swing and is the top priority. Much of the trade demand has been put on hold until the silage harvest quality can be evaluated. Hay quality has been greatly improved due to favorable recent weather conditions. An increase in harvested acreage is also being reported.

In Wyoming, all reported hay sales sold steady while demand was light to moderate. The highest demand has been seen on small square bales in the western portion of the state. Beet harvest is taking precedence for some producers now, and their attention will be again turned to hay when it completes.

Other things we are seeing

- Dairy: U.S. dairy exports continued to lag in August, with milk solids equivalent volume down 10.8% versus the same month a year ago. August trade data looked very similar to July, with U.S. nonfat dry milk and skim milk powder posting a respectable gain but most other product categories failing to match last year’s record performance. Year to date through August, U.S. export volume remains off by 6.9%, with value running -13% compared to January-August 2022. Separately, the Department of Commerce/Bureau of the Census estimated U.S. dairy exports through the first 11 months of fiscal year 2023 (October 2022-August 2023) at about $7.9 billion, down 5% from the same period a year earlier. Fiscal year-to-date dairy imports were estimated at $5.1 billion, up 15%, with cheese imports up 10% at $1.54 billion.

- Cattle: The latest Cattle on Feed report, published by the USDA National Agricultural Statistics Service (NASS), estimated the Aug. 1 feedlot inventory at 11.03 million head, over 2% below 11.289 million head in the same month last year. As anticipated, feedlot net placements in July were 9% lower year over year at 1.553 million head. However, marketings in July tallied 1.727 million head, down about 5% year over year. The year-over-year decline in marketings was largely expected with tighter cattle supplies.

- Fuel: Fuel prices remain steady across the board according to the U.S. Energy Information Administration (EIA). The U.S. retail price for regular-grade gasoline averaged $3.68 per gallon, a small increase since last month. The average U.S. retail diesel price was around $4.49 per gallon.

- Trucking: Spot flatbed prices ticked up over the month of September, with a change in average price of 0.5%, according to the DAT Freight and Analytics trendline. Regionally, average spot prices per mile were: Southeast – $2.59, Southcentral - $2.48, Midwest – $2.69, South – $2.59, Northeast – $2.45 and West – $2.28.