The holidays are ahead, and the sleigh is full of hay. Despite drought conditions over the summer, most areas are seeing a slight surplus of hay with lots of attractive-looking lots being offered up for sale. While the last of the fall grass is continuing to provide for cattle, the hay market is officially entering a buyer’s market in most parts of the country.

Take a closer look at prices and conditions in each region in the Progressive Forage Forage Market Insights column as of Nov. 10, 2023.

Moisture conditions increase

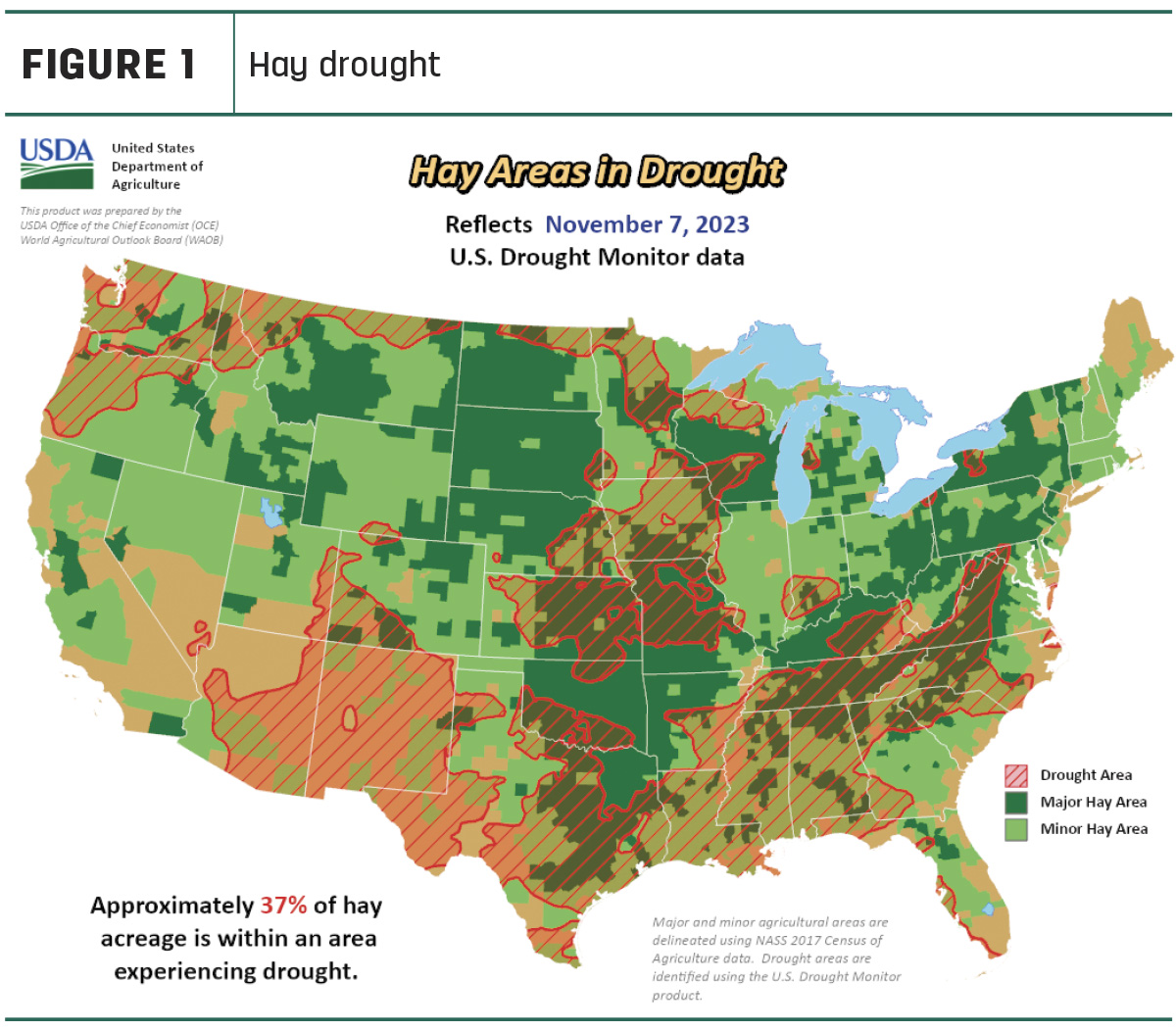

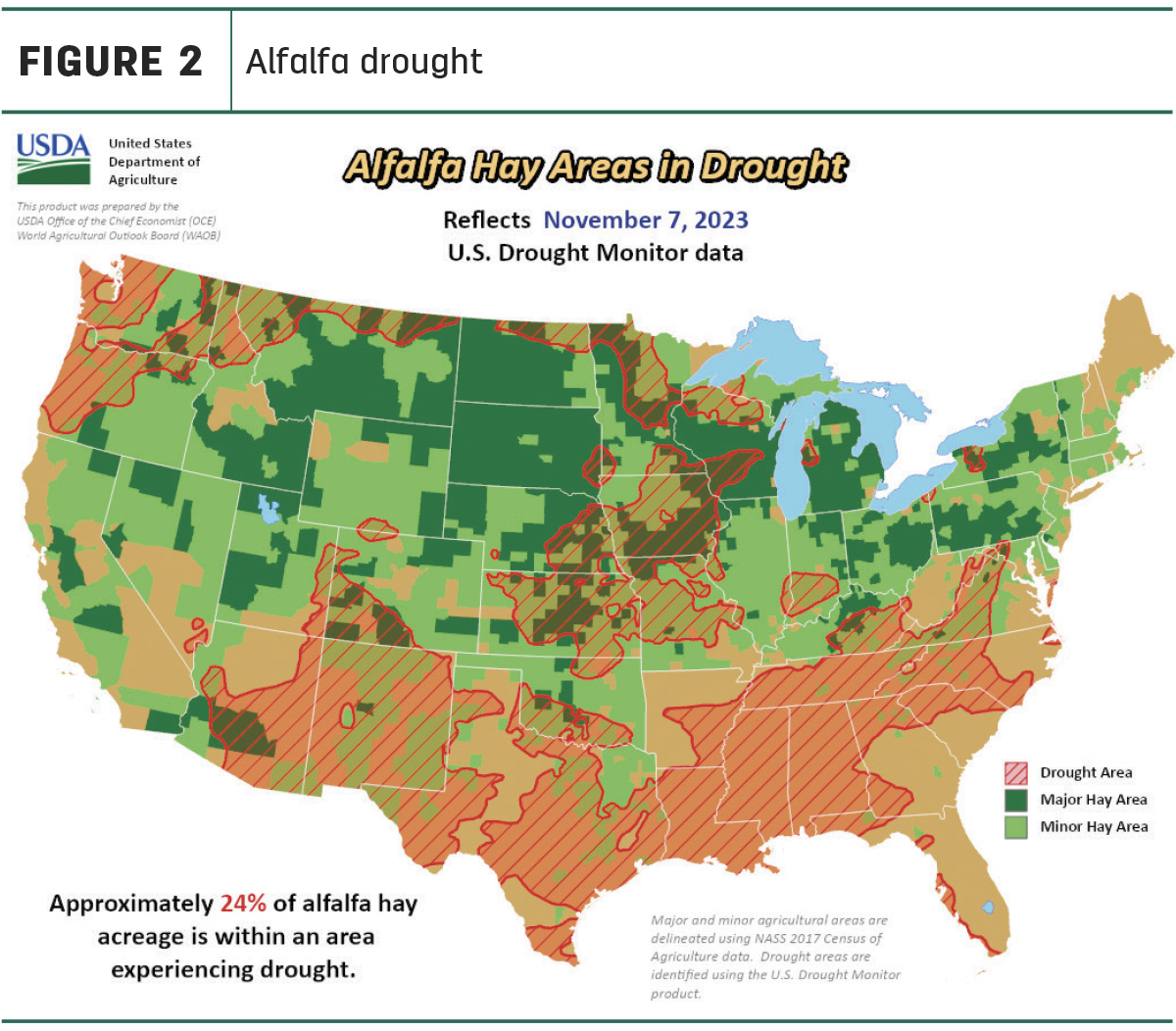

With reports of moisture in some parts of the country, overall U.S. drought monitor maps indicate drought areas that are in drought to be prevalent but decreasing.

As of Nov. 7, approximately 37% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions, with 41% being reported the month prior. The area of alfalfa hay-producing acreage (Figure 2) under drought conditions decreased to 24% from 34% the month prior.

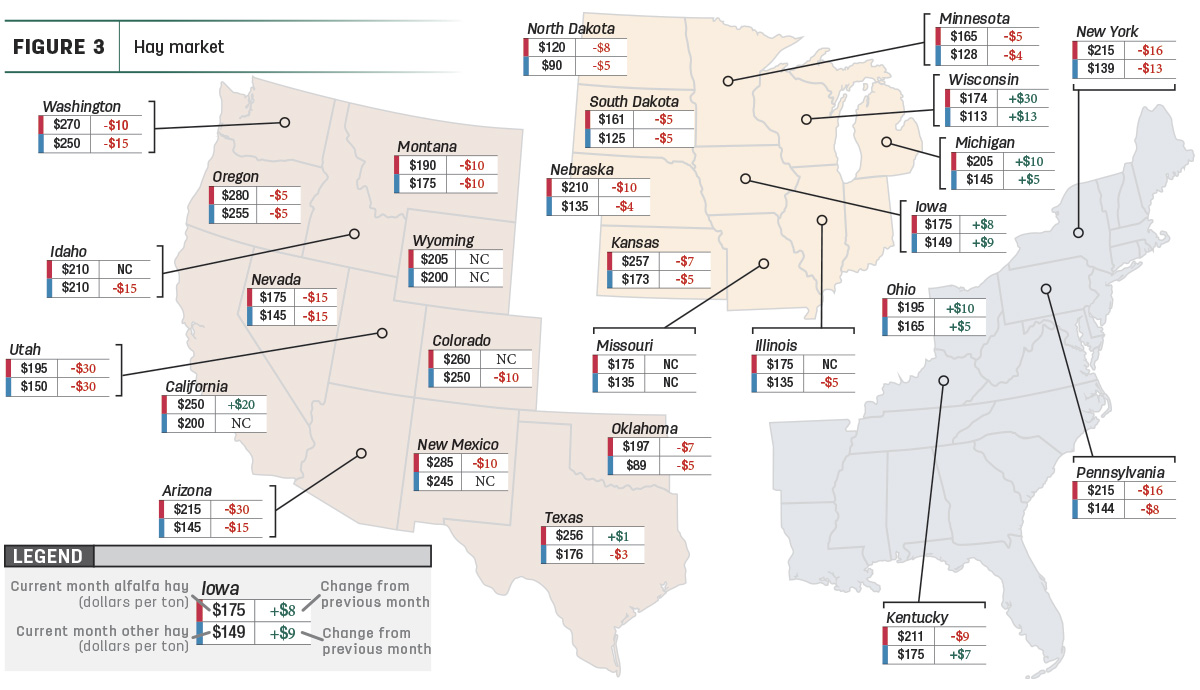

A snapshot of hay prices

Price data for 27 major hay-producing states is mapped in Figure 3, illustrating the most recent monthly average price and one-month change. The lag in USDA price reports and price averaging across several quality grades of hay may not always capture current markets, so check individual market reports elsewhere in Progressive Forage.

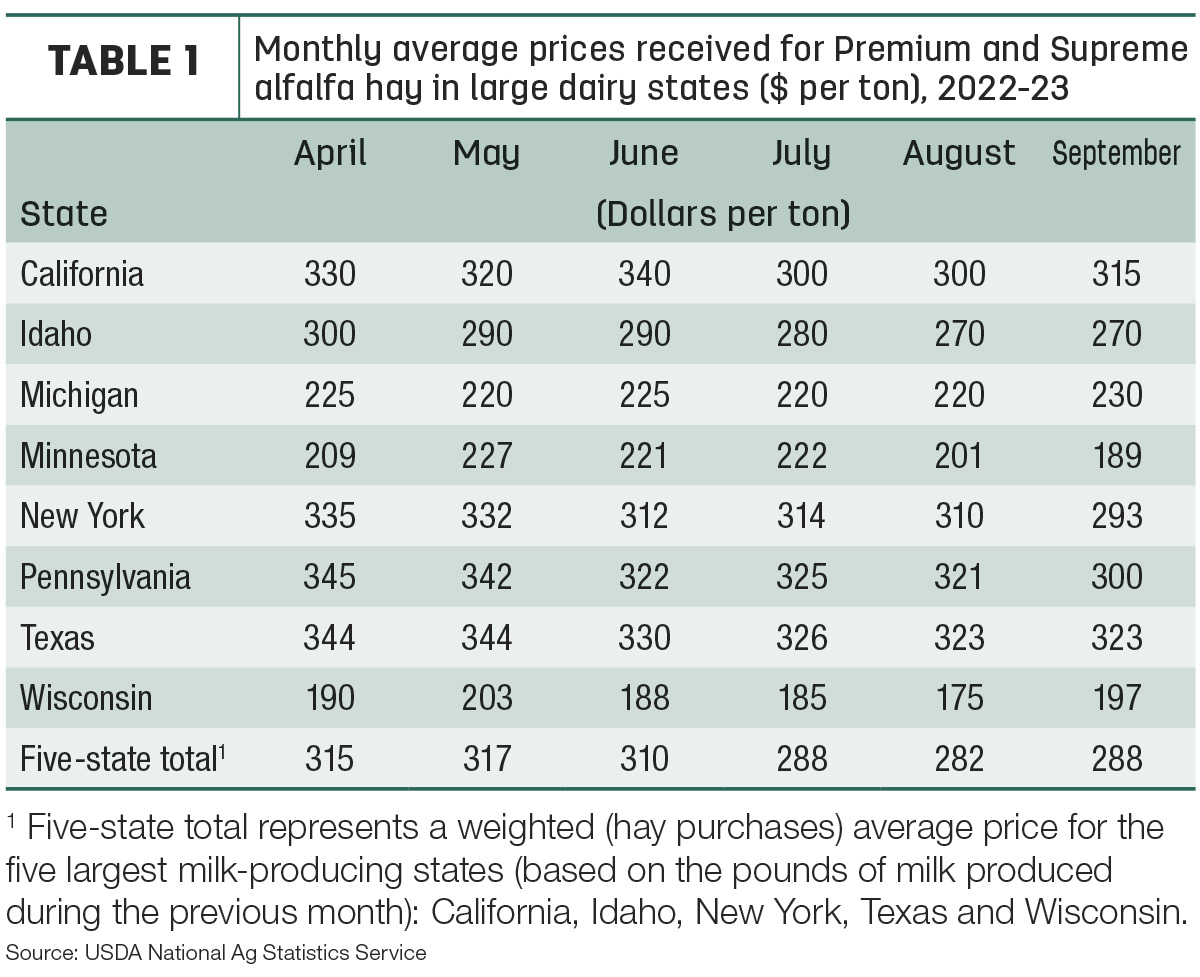

Dairy hay

The top milk-producing states reported a price of $288 per ton of Premium and Supreme alfalfa hay in the month of September, a $6 increase from August of this year. The price is $54 lower than what was reported in September 2022 (Table 1).

Regional markets

- Midwest: In Nebraska, hay sales are selling steady or up to $10 lower. Grass hay was also selling on the weaker side to steady. Delivered hay and dehydrated pellets sold steady. Demand was light, with some moderate demand in the dry parts of the state.

In Kansas, demand is low and trade is slow. Prices held mostly steady with the exception of alfalfa dropping in the southwest and south-central regions. While alfalfa is being offered, buyers are slow to make a deal.

In South Dakota, alfalfa hay moved steadily with a good demand as well as good demand for high-quality grass to start feeding calves with. As the weather remains steady, the push to buy hay has held off. Dairy producers are being pushed to buy low-cost hay because of tight margins, but cornstalk demand also remains moderate. Cornstalk baling is nearing completion.

In Missouri, following a hard freeze, temperatures returned to above normal. This enabled many producers to return to the field and still bale hay. The hay quality has been decent all things considered, due to the lack of frost and dew. Grain harvest is in the final stretch and is well ahead of average pace. Hay movement is steady along with prices, and supply is light to moderate with moderate demand.

- East: In Alabama, reported hay prices are holding steady and moderate demand is being reported.

In Pennsylvania, heavier-than-normal volumes of hay are being offered up for sale. Trade was active with several desirable lots of hay offered up for sale.

- Southwest: In California, trade activity and demand were moderate to good. Hay demand in the retail market was reported moderate to good. Export demand was reported as moderate. Across the state, corn silage harvest and fall groundwork neared completion. Some producers attempted to get one last cutting of alfalfa.

In New Mexico, alfalfa hay sold steady with an active trade and good demand reported. The majority of the state is wrapping up hay harvest for the season. Hay and roughage supplies were reported as short to very short for over half the state, with the other quarter being at adequate supply.

In Oklahoma, hay trade continues to be reported as slow, and the trades that are taking place are between established clients. Hay inventory is larger than usual and has caused the market to officially become a buyer’s market.

In Texas, hay prices are steady to firm across the state, with quality and freight costs being responsible for price variations. Temperatures are cooler and some rainfall that moved across the state helped drought conditions. Most regions of the state saw an improvement in drought conditions over the past month.

- Northwest: In the Columbia Basin, all grades of hay sold steady while trade remains slow with light demand. Reports of hay being replaced with other crops have come in.

In Montana, hay sold generally steady to $10 lower. Hay sales were mostly light again this week, with some sellers lowering asking price, leading to a bit more interest. Demand for hay to ship to Canada is lightening. No reported sales to Canada happened this week. Mild weather continues to curb demand as many ranchers are relying on the last of the fall grass to maintain for a few more weeks. Many ranchers also have hay listed for sale which indicates a surplus in supply and is increasing pressure on the hay market as a whole. Heavy straw supplies are continuing to be seen.

In Idaho, all grades of hay are selling steady with good demand existing for organic and high-testing markets. Light demand for hay with defects being reported. Producers in the southeast of the state are reporting they will be finished for the season.

In Colorado, trade activity and demand were moderate; the bulk of the activity remains in the horse hay markets, with horse hay still being sold steady. Dry conditions are still being reported, but with cooler temperatures drought conditions are decreasing. Most producers are reporting being done with harvest for the year.

In Wyoming, all reported hay sales sold steady while demand was reported to be lighter. Some producers are still waiting for the last cutting of hay to be dried down so it can be baled. Too much wind throughout the night has kept the dew from sticking around so the hay can be baled with the leaves staying attached. Producers are continuing to combine corn, sugarbeets and perform the last of the fall tillage.

Other things we are seeing

- Dairy: An improving U.S. dairy producer milk-feed income margin reduced Dairy Margin Coverage (DMC) insurance program indemnity payment on September milk marketings. The September DMC milk income over feed cost margin rose to $8.44 per hundredweight (cwt), limiting indemnity payments to dairy operations enrolled in DMC at Tier I insured levels of $8.50 and above. As a result, September DMC payments totaled about $35 million, the smallest monthly total for 2023. Through Nov. 8, DMC indemnity payments disbursed through the USDA’s Farm Service Agency (FSA) for the first nine months of 2023 had hit $1.27 billion. January-September DMC payments averaged $74,553 per dairy operation enrolled in 2023.

- Cattle: The swell of placements in September, along with less marketing, left the U.S. feedlot inventory with a total of 11.6 million head as of Oct. 1, 2023, according to the USDA’s October Cattle on Feed report. This is 1% more than last year’s feedlot placements and the second-highest Oct. 1 inventory since the series’ inception in 1996. Steers and steer calves made up 60% of feedlot placements with a total of 6.95 million head, a small increase from 2022. Heifers and heifer calves totaled 4.64 million head, up 1% from last year and comprising 40% of the total inventory.

- Fuel: Fuel prices are increasing across the board according to the U.S. Energy Information Administration (EIA). The U.S. retail price for regular-grade gasoline averaged $3.84 per gallon, a 16-cent increase since last month. The average U.S. retail diesel price was around $4.56 per gallon, a 7-cent increase.

- Trucking: Spot flatbed prices ticked down over the month of October with a change in average price of 0.9%, according to the DAT Freight and Analytics trendline. Regionally, average spot prices per mile were: Southeast – $2.51, South-central – $2.39, Midwest – $2.66, Northeast – $2.44 and West – $2.27.