While we patiently wait for the 2024 hay season to begin, prices for 2023 hay are remaining low. Some producers are ready to take lower prices to make room, while others are banking on old contracts to help move hay. Take a closer look at what prices and conditions exist in each region in the Progressive Forage Forage Market Insights column as of March 12, 2024.

Moisture conditions increase

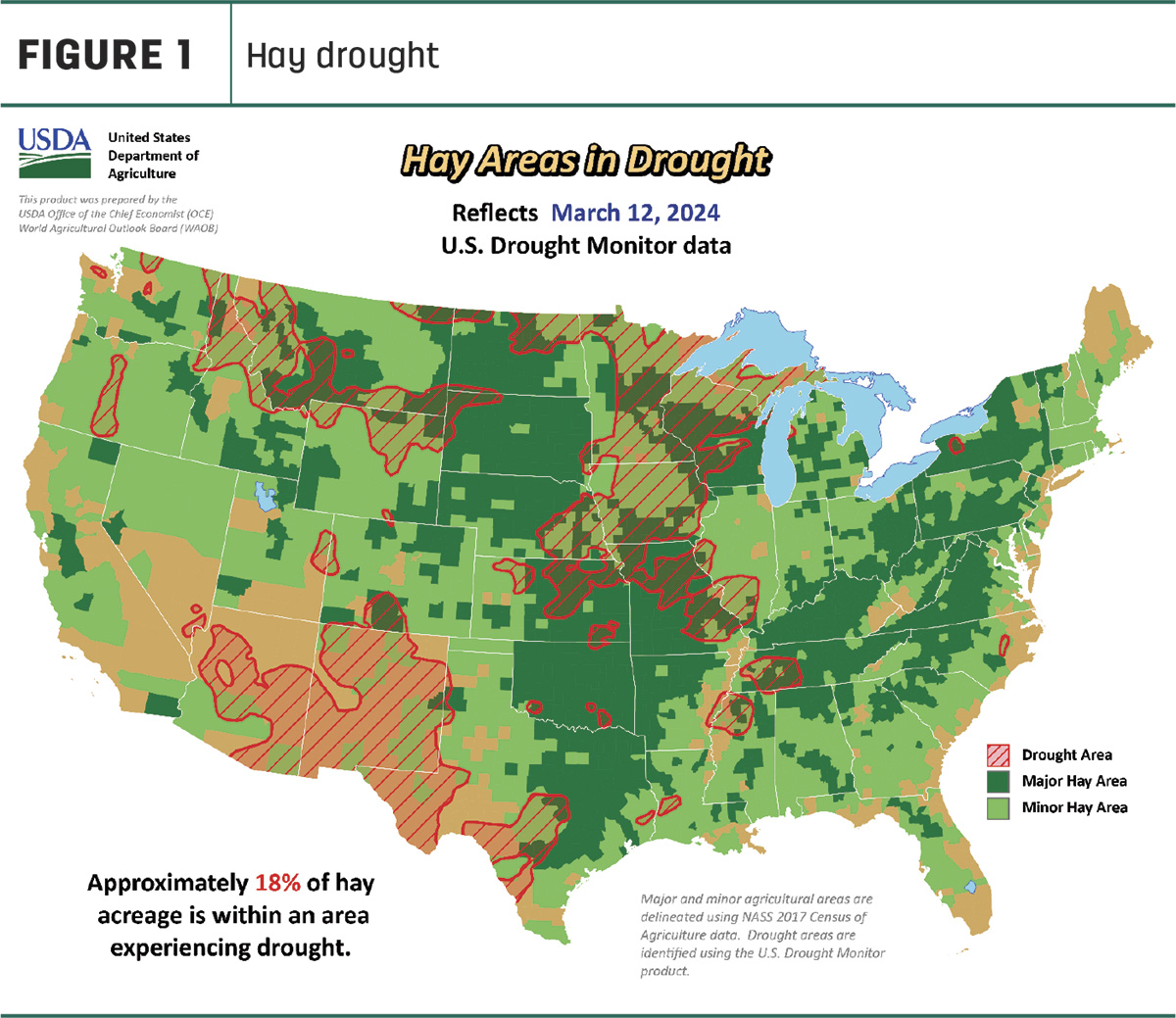

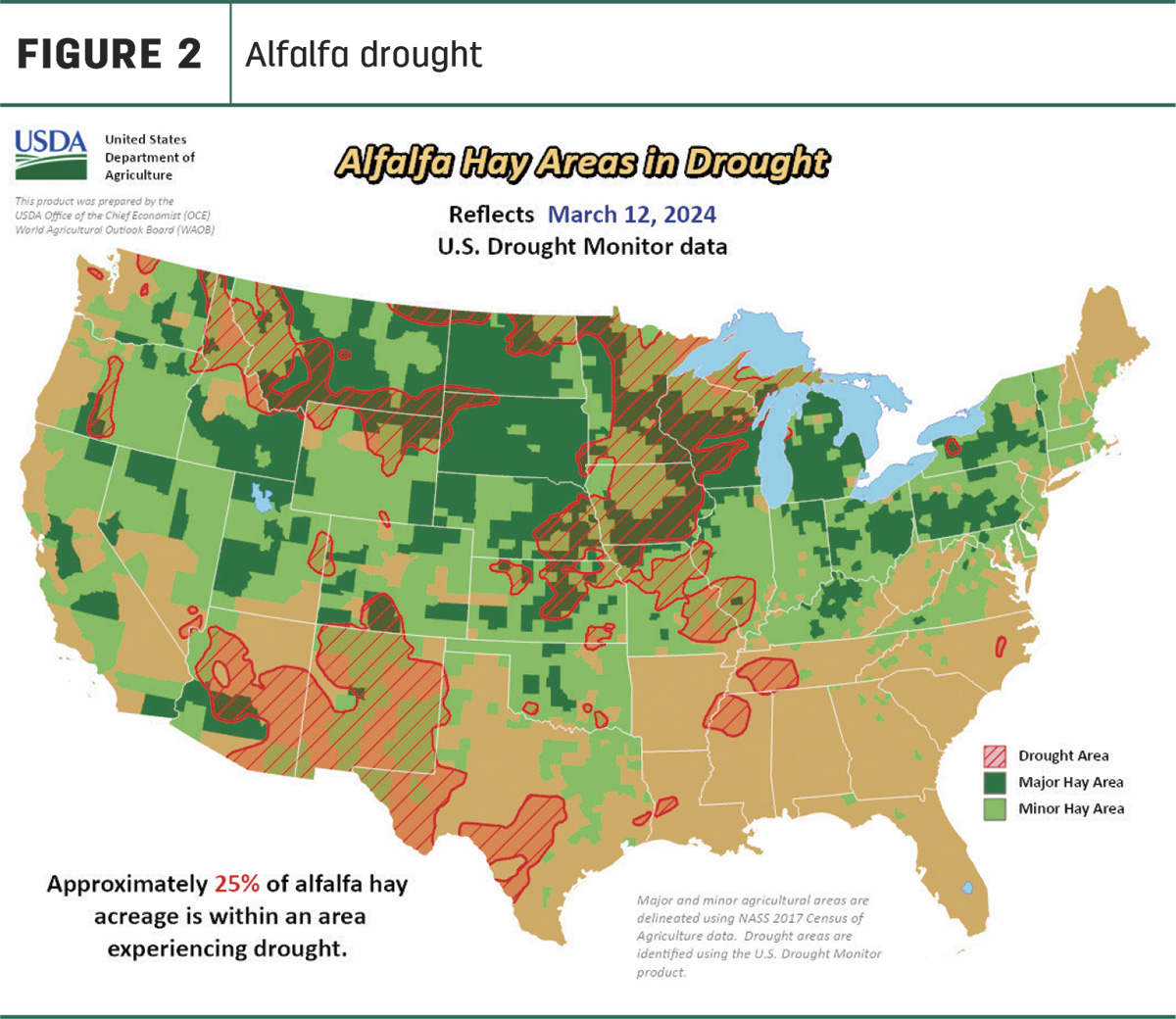

Increased spring rains and snow have improved moisture conditions. Overall U.S. drought monitor maps indicate that areas in drought are prevalent but decreasing. As of March 12, approximately 18% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions, with 19% being reported the month prior. The area of alfalfa hay-producing acreage (Figure 2) under drought conditions is reported to be 25%.

A snapshot of hay prices

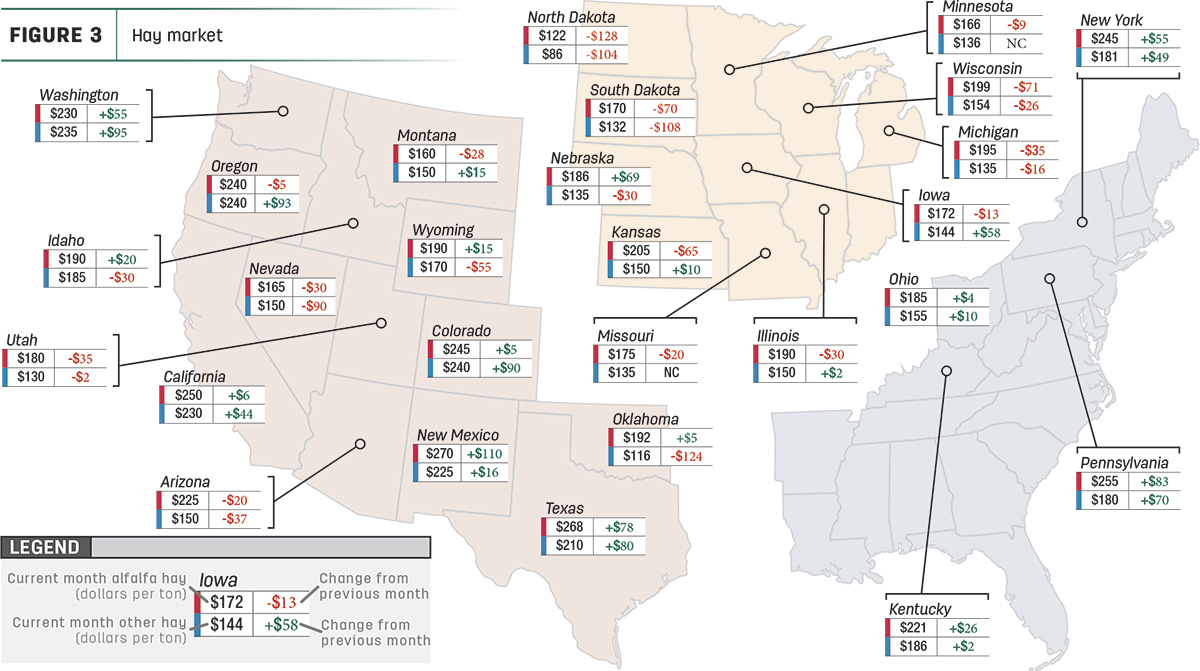

Price data for 27 major hay-producing states is mapped in Figure 3, illustrating the most recent monthly average price and one-month change. The lag in the USDA price reports and price averaging across several quality grades of hay may not always capture current markets, so check individual market reports elsewhere in Progressive Forage.

Dairy hay

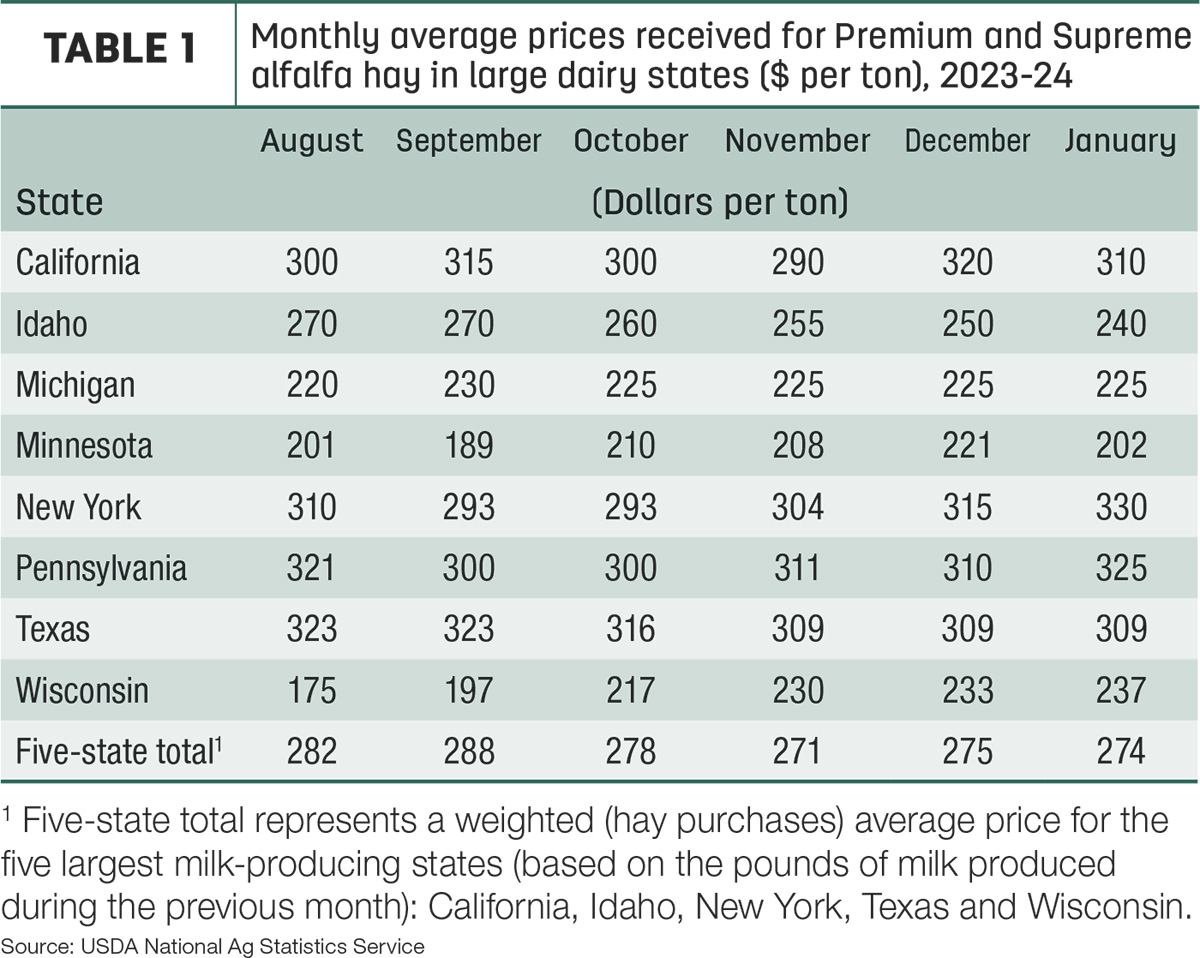

The top milk-producing states reported a price of $274 per ton of Premium and Supreme alfalfa hay in the month of January, a $1 decrease from December of last year. The price is $54 lower than what was reported in January 2023 (Table 1).

Regional markets

- Midwest: In Nebraska, grounded and delivered hay and hay pellets are steadily moving. In the eastern and central region, bales of grass hay and alfalfa are at a standstill. Demand across the board appeared to be light.

In Kansas, demand for alfalfa was moderate but light for grass hay. Spring greenup, lower cattle numbers and open weather have contributed to the light demand for supplemental hay in the market.

In South Dakota, alfalfa was weak. Dairy-quality hay saw moderate demand at best and was oftentimes lower. Light demand for round bales of alfalfa can be attributed to a lighter demand during the winter months as a result of a mild winter.

In Missouri, spring storms provided some much-needed rainfall. Ideally, this moisture will help the grass take off. The supply of hay is light to moderate, demand is moderate, prices are steady to weak.

- East: In Alabama, hay prices held steady with moderate trade, supply and demand.

In Pennsylvania, alfalfa and grass mix sold steady. Orchardgrass and prairie/meadow grass sold steady. Timothy sold steady on a light comparison.

- Southwest: In California, trade activity and demand was moderate. Retail hay demand was steady to good. Dairy hay demand was light to moderate, while export demand remained light. Weather conditions have fluctuated a lot. New growth in spring-planted crops has been fueled by spring rains. Herbicides and pesticides were applied to wheat and forage crop fields.

In New Mexico, alfalfa hay is steady with trade active and demand being good.

In Oklahoma, both demand and trade are slow. With the new hay crop approaching, many cattle producers are making what hay they have left stretch.

In Texas, hay prices are mostly steady. Trading activity was moderate with moderate demand. A lot of donated hay is moving into and across the state this week to help cattle producers in the Panhandle that have suffered major losses due to the wildfires moving across the region as over 1.2 million acres have burned so far, making it the largest fire in Texas history. Field prep for planting has begun across the state.

- Northwest: In the Columbia Basin, export and dairy hay were steady to firm. Exporters are showing more interest recently.

In Montana, hay sold generally steady. Light hay sales have been reported. Feeder-quality hay has some light demand as cattle producers are searching for something low-cost to stretch until the new crop is ready.

In Idaho, not enough trades were reported to make an accurate trend.

In Colorado, trade activity was light to moderate demand. Horse hay sold steady, but the bulk of moving hay is on old contracts.

In Wyoming, all reported hay sales remain to be holding steady while demand remains light. Producers are considering lower prices to clear barns and make room for the 2024 crop.

Other things we are seeing

- Dairy: The milk production forecast for 2024 was lowered from last month due to lower cow inventories and lower expected output per cow. At 226.4 billion pounds, the 2023 milk production estimate was lowered 200 million pounds from last month’s report and is virtually unchanged from 2022’s total of 226.4 billion pounds. In their latest report released March 5, the National Milk Producers Federation (NMPF) stated Cooperatives Working Together (CWT) program-assisted member cooperative year-to-date export sales totaled 24.5 million pounds of American-type cheeses, 112,000 pounds of anhydrous milkfat, 7.1 million pounds of whole milk powder and 2.2 million pounds of cream cheese.

- Cattle: The USDA National Agricultural Statistics Service (NASS) released its semiannual Cattle report on Jan. 31. The total of all cattle and calves on Jan. 1, 2024, was estimated at 87.157 million head, about 1.7 million fewer than the previous year. This marks the fifth year of contraction for aggregate beef and dairy cattle inventories and the 10th year of the current cattle cycle – the cyclical expansion and contraction of the national cattle herd over time.

- Fuel: The U.S. weekly all-grades conventional retail gas price for Feb. 26 came in at $3.23, a sharp increase from the $3.06 price on Jan. 29. That national price had held between $3.02 and $3.06 since Dec. 18. Diesel fuel prices likewise saw a bump going from a $3.86 national average on Jan. 29 to $4.10 on Feb. 19, before dropping a week later to $4.05 on the Feb. 26 average. Gas and diesel prices have been on a lower trajectory since early 2023. Diesel prices hit their peak in the U.S. average on Jan. 23, 2023, at $4.60 per gallon, while the conventional gas price reached its 2023 high during the summer vacation season at $3.81. Other flashpoint comparisons would be the $4.91 per gallon price in summer 2022 and $3.40 per gallon after the first weeks of Russia’s invasion into Ukraine.

- Trucking: Spot flatbed prices remained steady with no notable change in average price, according to the DAT Freight and Analytics Trendlines. Regionally, average spot prices per mile were: Southeast – $2.58, South Central – $2.36, Midwest – $2.71, Northeast – $2.55 and West – $2.18.