Here are the economic factors affecting your dairy as we turn the calendar into April.

- March FMMO milk class prices post small increases

- 2023 all-milk, mailbox price spread averaged about 81 cents

- Ag producer survey shows improvements in future outlook

- FMMO hearing update

- GDT index increases 2.8%

March FMMO milk class prices post small increases

Dairy producers’ milk checks should improve a little based on March 2024 Federal Milk Marketing Order (FMMO) blended milk class prices.

Announced on April 3, FMMO Class II, III and IV prices were also slightly higher compared to a month earlier. However, for those watching milk pools, the wide Class III-IV price spread will maintain substantial Class IV depooling incentives.

March 2024 FMMO pooling estimates, uniform prices and producer price differentials (PPDs) will be released on April 11-14 and summarized on April 15. Watch Progressive Dairy’s website for an update.

March class prices

Class prices announced on April 2 were:

- At $21.12 per hundredweight (cwt), the March Class II milk price is up 59 cents from February and $1.60 more than March 2023. It’s the highest since November 2023.

- At $16.34 per cwt, the Class III milk price rose 26 cents from February but is still $1.76 less than March 2023.

- At $20.09 per cwt, the March 2024 Class IV milk price is up 24 cents from February and $1.71 more than March 2023. It’s also the highest since November 2023.

Potentially affecting FMMO pooling, the March 2024 Class IV milk price is $3.75 more than the month’s Class III milk price.

The March 2024 advanced Class I base price was previously announced at $18.80 per cwt, 81 cents more than February 2024 but 19 cents less than March a year ago.

Butterfat value up; protein dips

Contributing to the March milk class price calculations, the value of butterfat was up from the previous month, but the protein value declined.

The value of butterfat increased 13.5 cents to about $3.29 per pound. The value of milk protein fell a dime from February to about $1.27 per pound.

The value of nonfat solids was down about 2.5 cents at $1.01 per pound, while the value of other solids increased about 1.5 cents to 28.8 cents per pound.

Looking ahead

Based on FMMO advanced prices and current futures prices, the outlook for March milk prices is mixed.

Already announced, the April 2024 advanced Class I base price is $19.18 per cwt, 38 cents more than March 2024 and 33 cents more than April a year ago. It’s the first year-over-year increase since January 2022-23.

However, as of trading on April 3, the Chicago Mercantile Exchange (CME) Class III milk futures price closed at $15.42 per cwt for April, down $1.16 from the March price. The Class IV milk futures price closed at $20.06 per cwt for April, down 3 cents from March.

If Class III-IV futures prices hold, the April Class III-IV milk price gap will grow to $4.64 per cwt, boosting incentives for Class IV depooling.

2023 all-milk, mailbox price spread averaged about 81 cents

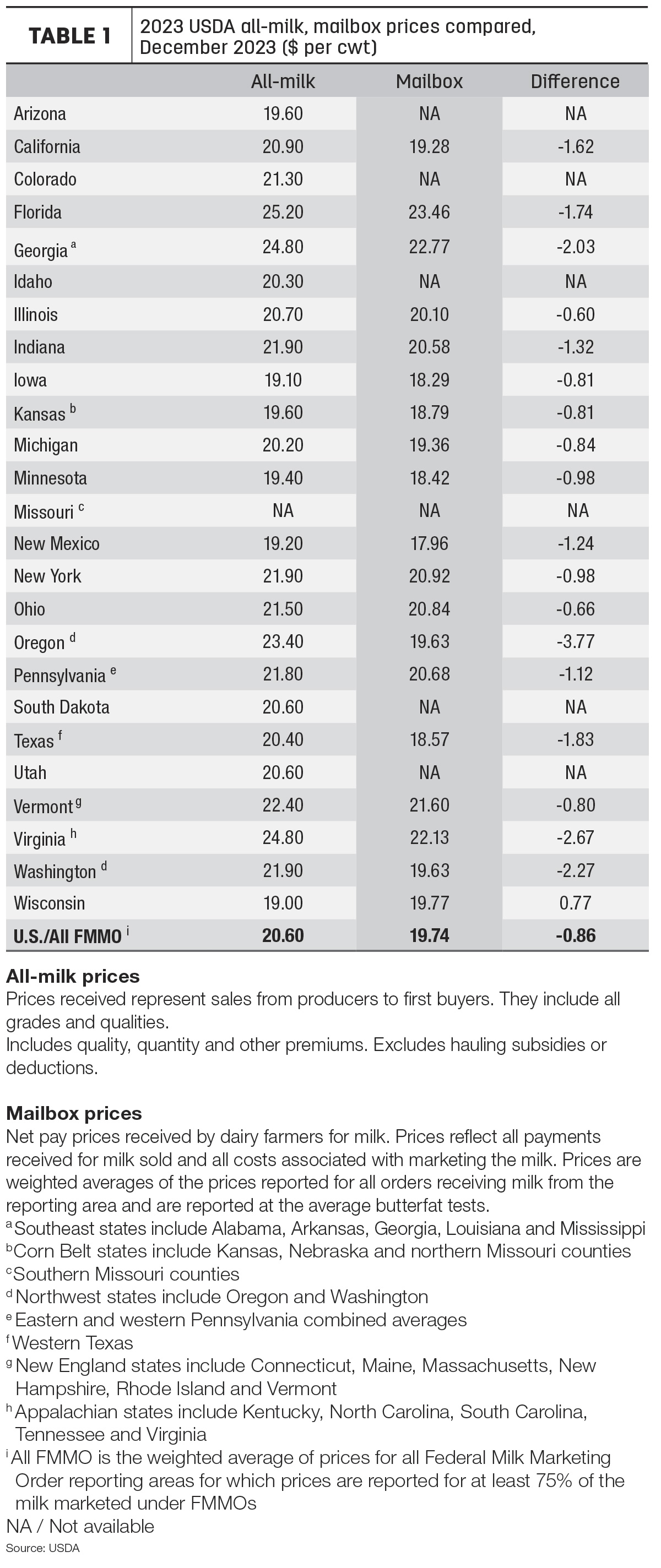

FMMO “mailbox” prices averaged about 81 cents per cwt less than announced average “all-milk” prices in 2023. Latest comparisons for December 2023 include:

- December U.S. all-milk prices averaged $20.60 per cwt, down $1.10 from November 2023. All-milk prices are reported monthly by the USDA National Ag Statistics Service (NASS). The all-milk price is the estimated gross milk price received by dairy producers for all grades and qualities of milk sold to first buyers, before marketing costs and other deductions. The price includes quality, quantity and other premiums, but hauling subsidies are excluded.

- The December 2023 mailbox prices for selected FMMOs averaged $19.74 per cwt, down $1.06 from October. The mailbox price is the estimated net price received by producers for milk, including all payments received for milk sold and deducting costs associated with marketing. Prices for milk in areas not regulated under the FMMO system are not included. Mailbox prices are reported monthly by the USDA’s Agricultural Marketing Service (AMS) and generally lag all-milk price announcements by a month or more.

With December’s estimates, the 2023 monthly mailbox price averaged $19.67 per cwt, about 81 cents less than the average all-milk price of $20.48 per cwt. Both were down substantially from the year before, when the all-milk price averaged $25.34 per cwt and the mailbox price averaged $24.64 per cwt. The 2022 spread between the two prices was 79 cents.

As Progressive Dairy notes each month, there’s a disclaimer of sorts. The price announcements reflect similar – but not exactly the same – geographic areas (Table 1). Also, within states and FMMOs, individual milk handlers and cooperatives may include a wide range of “market adjustment factors” impacting producer-member mailbox prices.

The difference in the two announced prices can affect individual dairy risk management results.

Ag producer survey shows improvements in future outlook

Producers’ expectations for interest rates shifted in March, resulting in some optimism for farm financial conditions, according to the latest Purdue University/CME Group Ag Economy Barometer.

Nearly half of this month’s respondents said they expect interest rates to decline over the next 12 months. This is fueling a slight uptick in the number producers who think now is a good time for large investments.

“Producers who feel it’s a bad time to invest continue to point to high machinery and construction costs along with high interest rates,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture.

Interest in using farmland for solar energy production and sequestering carbon appears to be on the rise, with 12% of respondents discussing solar energy leases and 18% saying they or their landowners were approached about possible carbon capture utilization and storage on farmland.

The Ag Economy Barometer provides a monthly snapshot of farmer sentiment regarding the state of the agricultural economy. The survey collects responses from 400 producers whose annual market value of production is equal to or exceeds $500,000. Minimum targets by enterprise are as follows: 53% corn/soybeans, 14% wheat, 3% cotton, 19% beef cattle, 5% dairy and 6% hogs. Latest survey results, released April 2, reflect ag producer outlooks as of March 11-15.

FMMO hearing update

A milestone in the FMMO national pricing formula hearing was met on Monday, April 1. That was the final day to file a post-hearing brief.

Following the close of the public hearing on Jan. 30, participating organizations were able to submit their final statements summing up their arguments for why the USDA should adopt their proposals as part of a new federal order.

The USDA now has 90 days to issue a recommended decision in the Federal Register. That’s followed by a 60-day comment period and another 60 days for the USDA to develop their final decision.

Hearing transcripts, post-hearing documents and updates can be found on the hearing website.

GDT index increases 2.8%

The price index of dairy product prices sold on the Global Dairy Trade (GDT) platform increased in an auction held April 2. Compared to the previous auction, prices for individual product categories were mostly higher, led by increases of 3% or more in the prices for butter, whole milk powder and cheddar cheese. Others posting smaller price increases were anhydrous milkfat and skim milk powder. Lactose was down 3.1%, while there was little to no change in butter milk powder and mozzarella.

The GDT platform offers dairy products from several global companies: Fonterra (New Zealand), Darigold, Valley Milk and Dairy America (U.S.), Amul (India), Arla (Denmark), Arla Foods Ingredients (Denmark) and Polish Dairy (Poland).

The next GDT auction is April 16.