If you file taxes on a cash basis, as most farmers and ranchers do, and you’ve had a good income year, late-in-the-year tax planning may suggest you should increase deductible expenses for the year to keep from paying an excessive amount of income tax.

One way to do that is to prepay for some supplies; that is, pay ahead of time (in the current tax year) for fertilizer, feed, seed, fuel, etc., which you won’t take delivery of until sometime in the next tax year.

But if you write a check in December to prepay for some fertilizer, how should you enter that transaction in your accounting records? The check entry needs to record fertilizer expense, of course. But it also needs to record the prepaid fertilizer as an asset of the farm business – something the fertilizer dealer owes you, much like accounts receivable – so it will show up on any balance sheet reports you print.

Most people in farming and ranching who use QuickBooks accounting software, use it for single-entry cash bookkeeping. If you have QuickBooks and that’s also how you use it, you may think that recording something as both an expense and an asset at the same time is not possible. But it can be done and is easier than you might expect.

Let’s consider an example based on writing a $10,000 check to prepay for some fertilizer. We will look at how to enter the check first, then follow up with details about the necessary accounts, etc. Steps and illustrations are based on QuickBooks desktop editions (Pro, Premier, Accountant and Enterprise) because they are more flexible for many farm/ranch accounting activities than QuickBooks Online (cloud-based) editions.

(By the way, the approach described in this article works for any kind of prepaid expenses, not just fertilizer.)

Entering a check for prepaid fertilizer

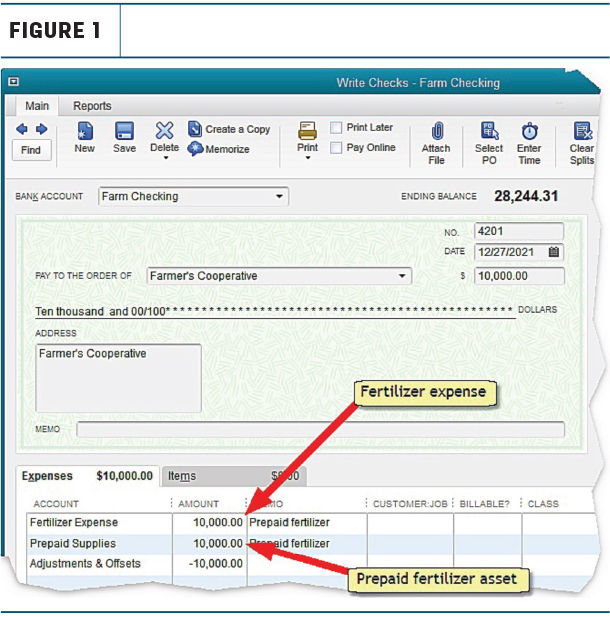

Figure 1 shows a check entry for the $10,000 fertilizer prepayment.

The first detail line of the check probably looks familiar. It posts $10,000 to an account named Fertilizer Expense, the same as you might record fertilizer expense on any check. The second and third lines may be less familiar. The second line increases the balance of Prepaid Supplies – an asset account – by $10,000 and the third line offsets that amount by posting a -$10,000 (negative) amount to Adjustments & Offsets, an equity account. These two lines’ amounts cancel each other out, leaving the net amount of the check at $10,000.

Explanation: QuickBooks is a double-entry system, meaning that every transaction affects at least two accounts (even if you don’t realize it). Having an account like Adjustments & Offsets to use for “throwing away” the parts of double-entry transactions we don’t want allows single-entry record keepers to do special things without affecting the wrong accounts.

Accounts you will need

Assuming you have purchased fertilizer before, you probably already have a fertilizer expense account of some kind, so to save space, we won’t show how to set up that account here. But you might not have prepaid supplies and adjustments and offsets accounts, so both are described below.

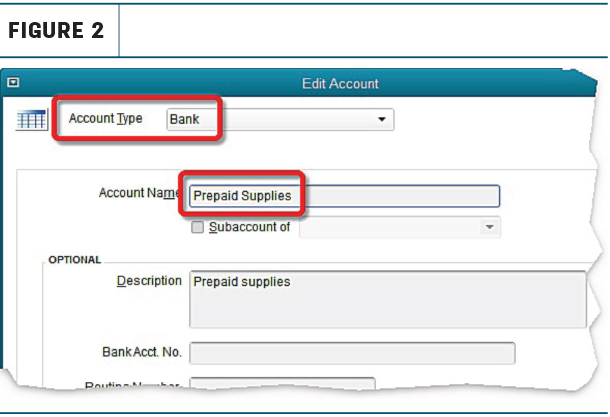

Prepaid supplies are a current asset – something you’ll likely use within one year – so it would make sense to set up a Prepaid Supplies account using the Other Current Asset account type (one of QuickBooks’ account types). But as you will see later, there are advantages to setting it up as a Bank type account, as shown in Figure 2.

“Wait a minute!” you might say. “Prepaid supplies has nothing to do with banking. Why are you calling it a bank account?” That’s not what is happening here. The Bank account type is often used to represent things that are not actually bank accounts, such as investment accounts, PayPal accounts or clearing accounts. More importantly, QuickBooks will only let Bank type accounts use the Write Checks window. As you will see later, that is the main reason for setting up Prepaid Supplies as a Bank type account.

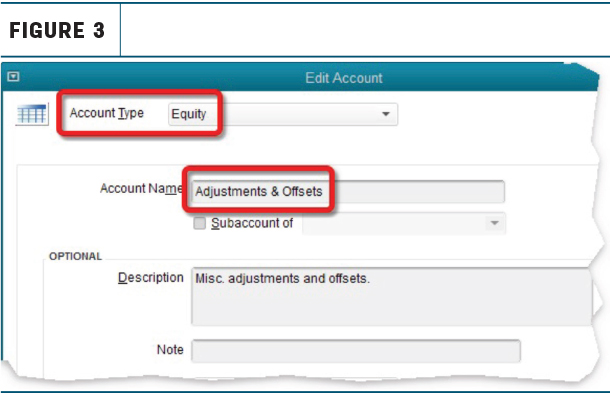

Figure 3 shows the setup window for an Adjustments & Offsets account, which is mostly used for discarding the “unneeded” part of double-entry transactions when using QuickBooks for single-entry cash accounting.

When the dealer’s statement arrives

Next spring, after some of the fertilizer has been applied, your dealer’s monthly statement should normally show how much of your prepayment was “used up” to purchase fertilizer, and you can use that information to reduce the balance in Prepaid Supplies by the same amount.

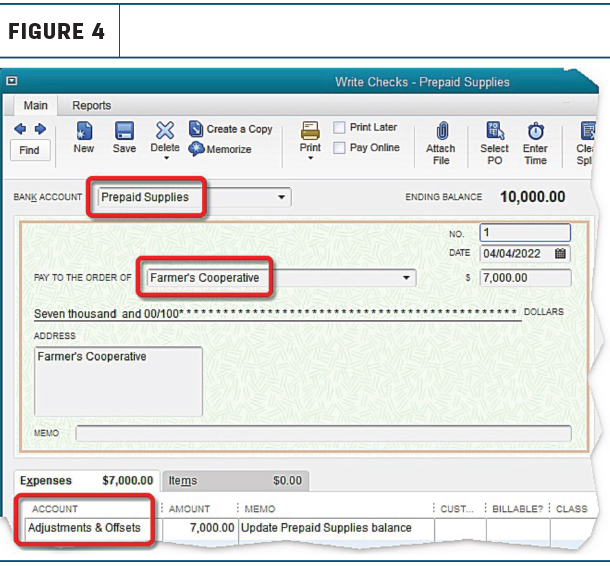

Let’s say the statement shows that $7,000 of your prepayment has been applied to fertilizer purchases. Because Prepaid Supplies is a Bank type account, you can update its balance by simply writing a check – not a real check, but an entry in the Write Checks window to draw down the balance in Prepaid Supplies by $7,000, as shown in Figure 4.

Things to notice in Figure 4:

- Prepaid Supplies is selected as the bank account. Though the dealer’s name is selected as the payee, this “check” won’t be printed and won’t be sent to the dealer. But selecting the dealer’s name here will make it easy to find this transaction in QuickBooks later, if the need arises.

- Adjustments & Offsets is selected as the “expense” account. Remember, it is not an expense account but rather an equity type account. So this check simply reduces the balance in Prepaid Supplies by $7,000 and “throws away” the offsetting part of the transaction by posting it to Adjustments & Offsets. Important: do not select an actual expense account here – the fertilizer was already deducted as an expense in the prior year, when the $10,000 prepayment was entered.

Balance sheet adjustments

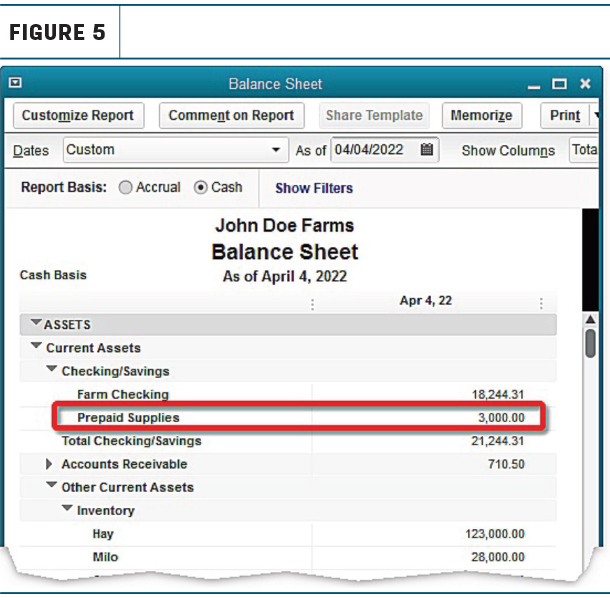

If we prepared a balance sheet after entering the $7,000 “check” shown in Figure 4, the report looks something like Figure 5.

The $3,000 Prepaid Supplies balance is correct; that is the amount of asset value remaining after subtracting $7,000 from the original $10,000 prepayment.

But do you notice a problem? Prepaid Supplies is listed in the Checking/Savings section of the report and included in the amount on the Total Checking/Savings line. To others who might view your balance sheet report – your lender, partners or others – having Prepaid Supplies listed in the Checking/Savings section could raise questions about whether the report contains errors.

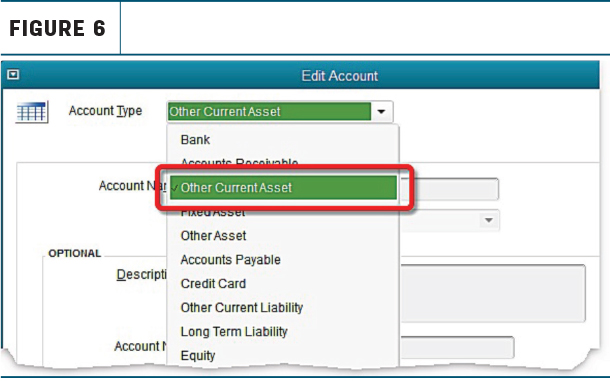

Fortunately, QuickBooks makes this easy to fix. Simply change your Prepaid Supplies’ account type from Bank to Other Current Asset, as shown in Figure 6.

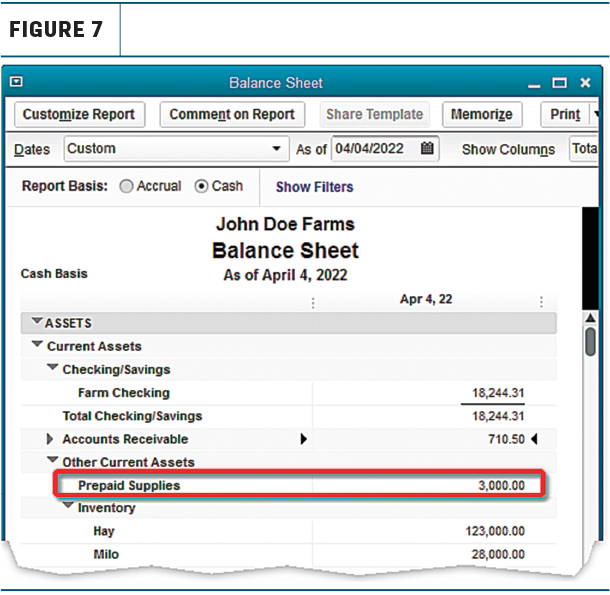

After making that change, Prepaid Supplies will appear in the Other Current Assets section of the balance sheet reports, where it should be (Figure 7).

After preparing a balance sheet report, be sure to change the Prepaid Supplies’ account type back to Bank. Why? Because QuickBooks won’t let you select Prepaid Supplies in the Write Checks window until you make it a Bank type account again.