Dairy margins were relatively flat over the last half of March, with limited price movement in either milk futures or feed markets, according to Commodity & Ingredient Hedging LLC.

Moving into the first half of April, dairy margins were mixed, weakening in nearby periods while holding steady further out. Continued pressure on Class III milk futures due to weakness in dairy product prices was the culprit behind declining spot margins, with spot cheddar blocks and whey powder prices dropping to one- and two-month lows.

Here’s an update on risk management tools available through the USDA and/or USDA’s Risk Management Agency (RMA), as well as other information impacting your milk check.

Dairy Margin Coverage (DMC) program

The March 2023 DMC margin will be announced on April 28, with large indemnity payments expected.

The February DMC margin was $6.19 hundredweight (cwt), triggering Tier I indemnity payments at $6.50-$9.50 cwt coverage levels and Tier II indemnity payments at $6.50-$8 per cwt coverage levels. Payments on February 2023 milk marketings enrolled in the program topped $122 million, bringing total payments for the first two months of 2023 to more than $179.3 million.

January-February DMC payments averaged $10,659 per dairy operation enrolled in 2023. All 2023 payments are subject to a 5.7% sequestration deduction.

Latest data, as of April 3, showed 16,824 dairy operations are enrolled in the 2023 DMC program, representing about 72.6% of operations with established production history. Annual milk volume covered under the program totals 156.6 billion pounds, about 78% of production history established in 2023. The total does not include enrollment in the Supplemental DMC program.

Based on current futures prices and DMC decision tool calculations as of April 18, the forecast DMC margins for March and April are about $6.60 per cwt, falling to $5.81 per cwt in May and $6 per cwt in June.

Dairy Revenue Protection (Dairy-RP)

Dairy producers managing risk through the Dairy Revenue Protection (Dairy-RP) program are currently eligible to cover revenue from the third quarter of 2023 through the third quarter 2024.

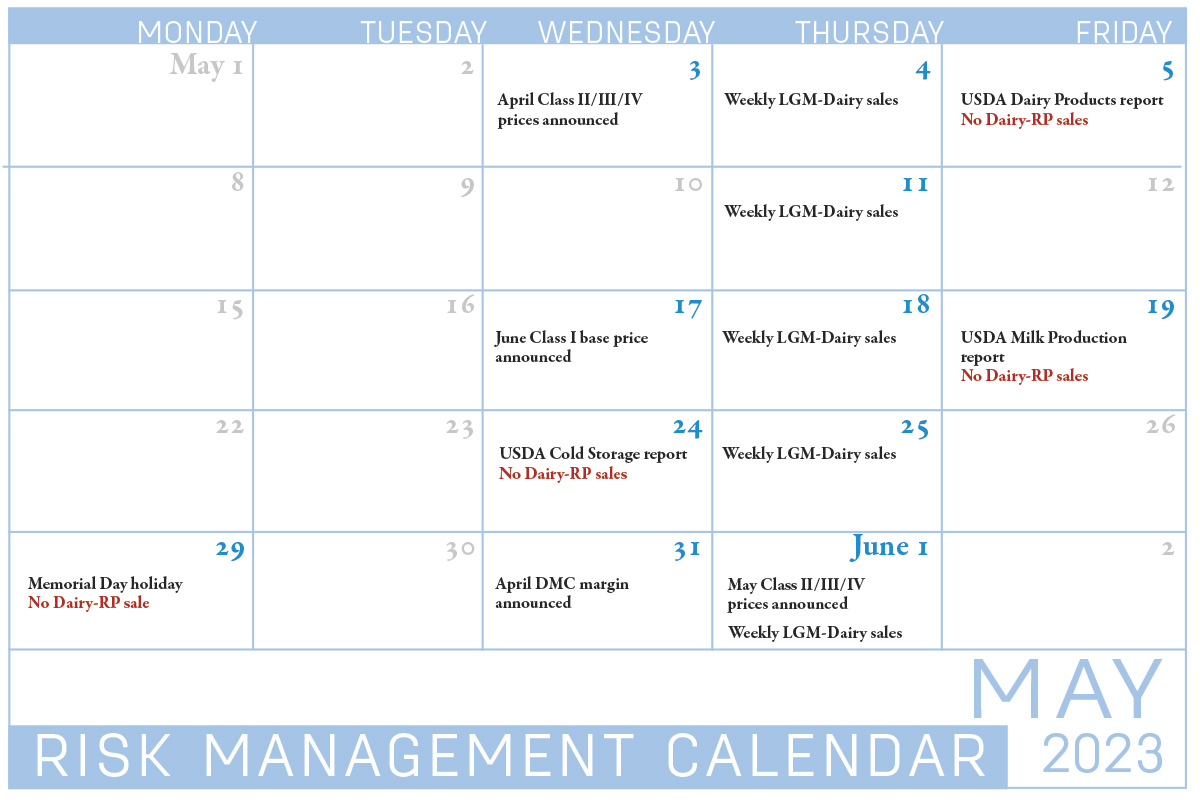

Dairy-RP coverage cannot be purchased on days when major USDA dairy reports that could impact markets are released, including Milk Production, Cold Storage and Dairy Product reports (see Calendar). Dairy-RP is also not available on days when applicable futures contracts move limit-up or limit-down, or on days when Chicago Mercantile Exchange (CME) trading is closed due to holidays. The Memorial Day holiday, May 29, impacts Dairy-RP availability this month.

The market changes daily and Dairy-RP endorsements must be purchased between the CME market closing and the next CME opening.

Livestock Gross Margin for Dairy (LGM-Dairy)

Livestock Gross Margin (LGM-Dairy) is another subsidized margin insurance program administered by the USDA’s RMA.

LGM-Dairy provides protection when feed costs rise or milk prices drop and can be tailored to any size farm. LGM-Dairy uses futures prices for corn, soybean meal and milk to determine the expected gross margin and the actual gross margin. LGM‑Dairy is similar to buying both a call option to limit higher feed costs and a put option to set a floor on milk prices.

Coverage can be purchased on expected milk marketings over a rolling 11-month insurance period. For example, the coverage period available during the final week of April contains the months of June 2023 through April 2024.

Sales periods for the LGM-Dairy program are open on a weekly basis. Unlike Dairy-RP, LGM-Dairy is available even if a sales period falls on the day of a USDA report. Premium payments are due at the end of the insurance period.

FMMO data

Affecting March margins, administrators of the 11 Federal Milk Marketing Orders (FMMOs) reported March 2023 prices and pooling data. Uniform or blend prices and producer price differentials (PPDs) were lower in 10 of 11 FMMOs, the “average-of” Class I mover formula provided a small benefit on Class I prices, and more milk returned to FMMO pools.

Read: March 2023 FMMO uniform prices mostly lower

March milk production

Weaker milk output per cow in California and fewer milk cows in Wisconsin helped cap year-over-year milk production growth in March 2023. The March data was also collected prior to the fire that killed an estimated 18,000 cows at South Fork Dairy in Dimmitt, Texas, on April 10. Read: March 2023 milk production up 0.5%

WASDE outlook

The USDA’s monthly World Ag Supply and Demand Estimates (WASDE) report was released April 11. Compared to last month, the USDA raised the U.S. milk production estimate for 2023 slightly but also raised Class III and all-milk price forecasts.

Read: Weekly Digest: USDA raises 2023 Class III price projection

Check the Progressive Dairy website for updates affecting milk prices as they become available.

Protecting Your Profits update

Pennsylvania Center for Dairy Excellence (CDE) risk education manager Zach Myers will host a special edition of his “Protecting Your Profits” session, April 26. The webinar will feature Chris Wolf, Cornell University dairy economist, who will provide an update on the FMMO reform process. Myers will also review current milk market data and providing updates to guide decision-making and risk management strategies.

The webinar session will be held live, 12-1 p.m. (Eastern time), with a recorded version available later. To join the risk management discussion in a webinar, podcast or conference call format, visit the Protecting Your Profits website. There is no cost and no registration is necessary.