With spring cropping plans taking shape, many U.S. hay and forage growers are starting the new growing season under the best moisture conditions in quite a while, and fuel, fertilizer and chemical prices are down from a year ago. Affecting the demand side, the numbers of forage-consuming beef and dairy cows and replacement heifers are lower. Here’s a look at hay markets and conditions in mid-February.

Moisture conditions improved

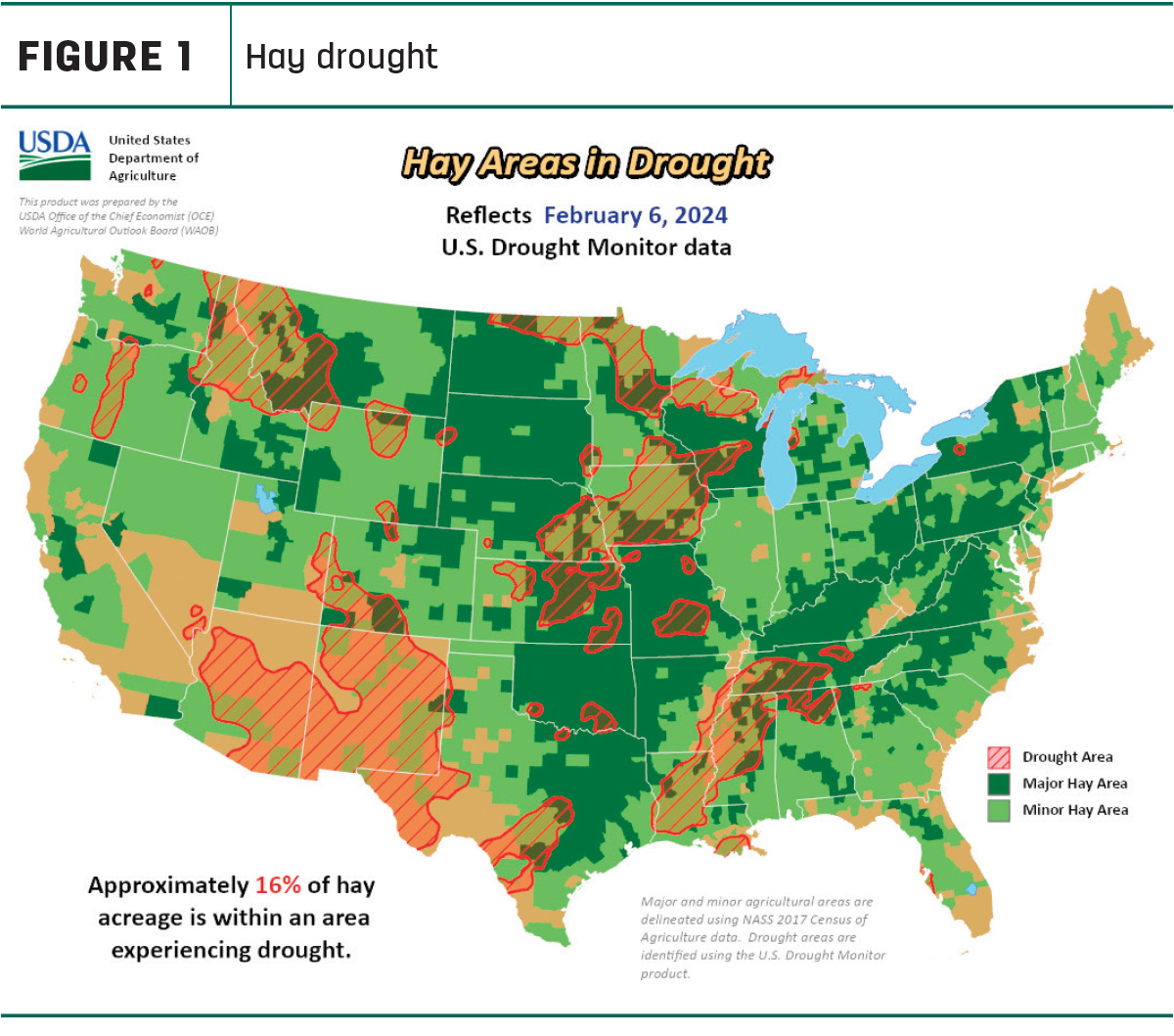

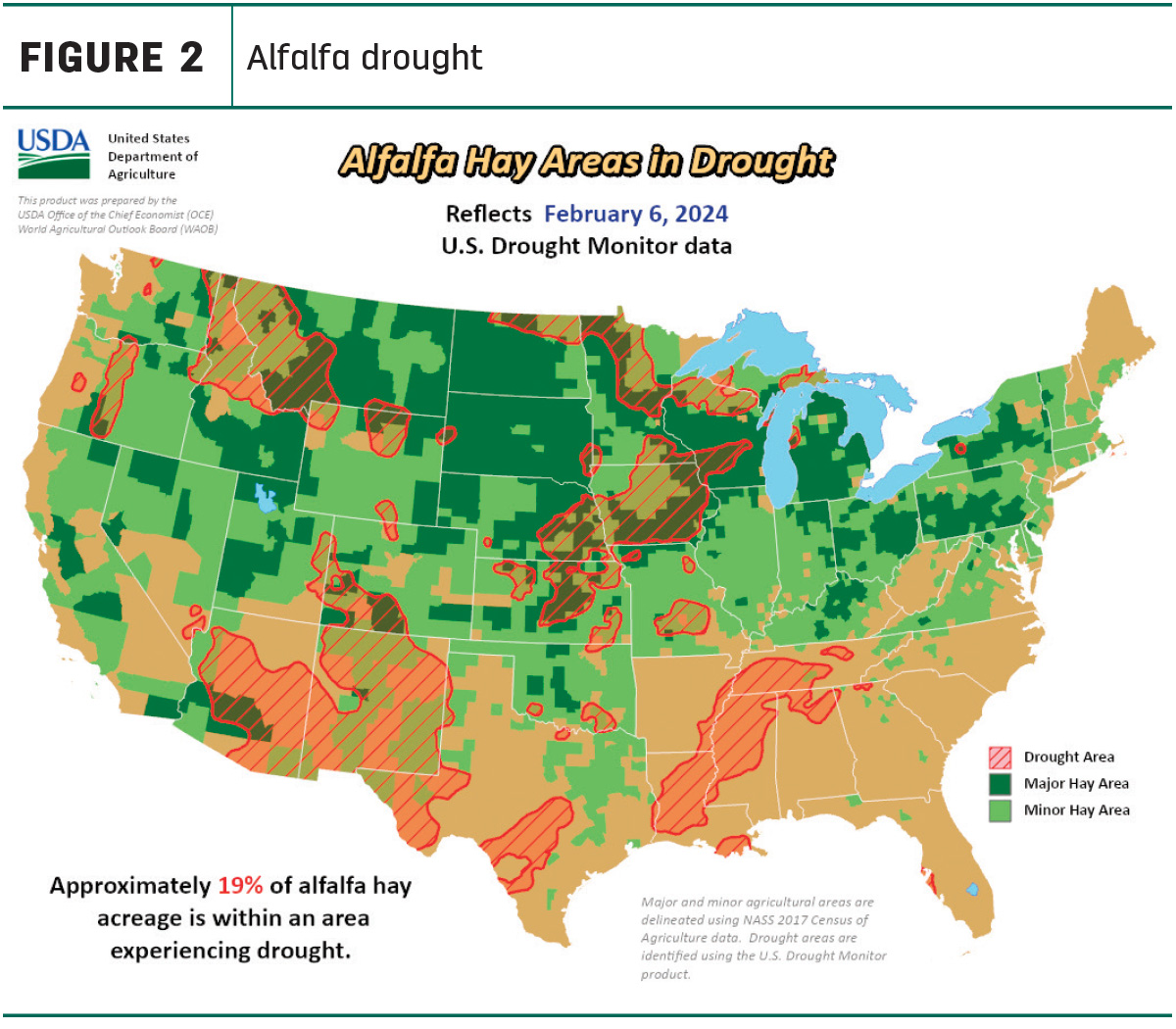

U.S. Drought Monitor maps indicate drought areas continue to shrink. As of Feb. 6, about 16% of U.S. hay-producing acreage (Figure 1) was considered under drought conditions, 15% less than a month earlier. The area of drought-impacted alfalfa acreage (Figure 2) was estimated at 19%, down 3% from early January. Both are the lowest since May-June 2020.

Geographically, early February news was mixed. A strong Pacific storm system brought flooding rains to California and heavy snow to the mountain ranges of Northern California and the Sierra Nevada, along with rain and snow to the Pacific Northwest and inland regions of the West. However, snow water equivalent remained below normal at 78% of stations in the West, with worst conditions in western Montana, northern Wyoming, northern Idaho and western Washington.

Another round of showers and thunderstorms passed through the South and Southeast. The northern Plains, Upper Midwest and Northeast stayed relatively dry.

Hay prices tracked

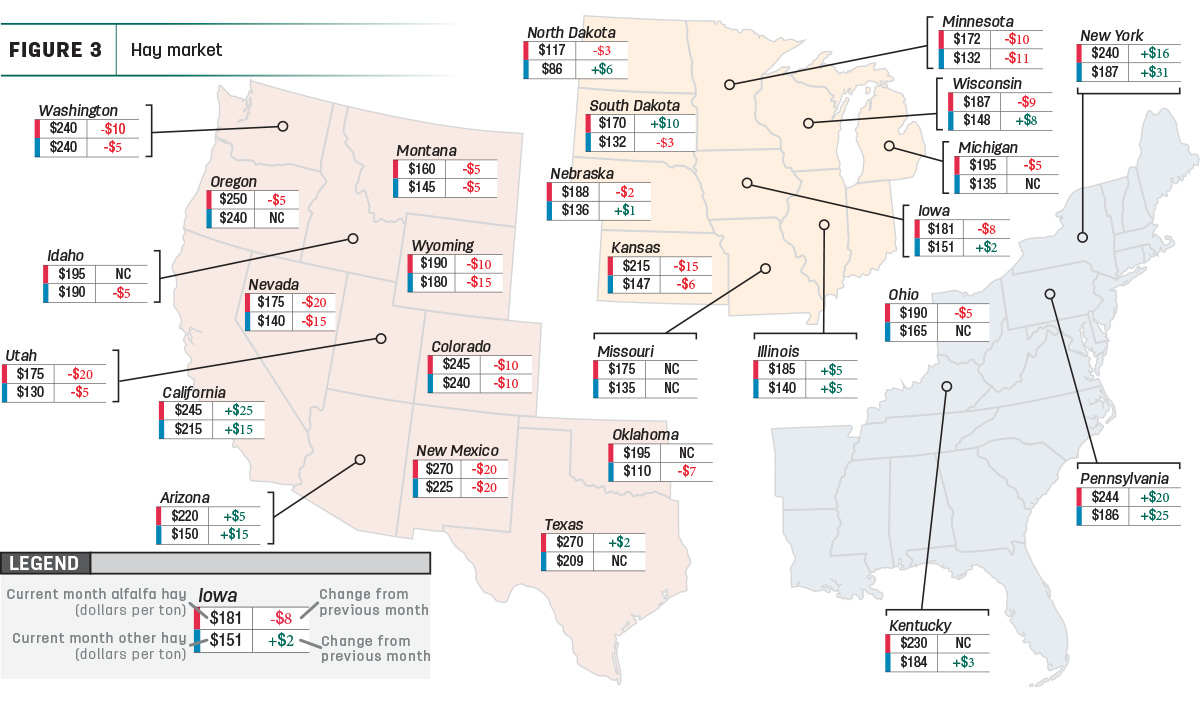

Price data for 27 major hay-producing states is mapped in Figure 3, illustrating the most recent monthly average price and one-month change. The lag in USDA price reports and price averaging across several quality grades of hay may not always capture current markets, so check individual market reports elsewhere in Progressive Forage.

Dairy hay

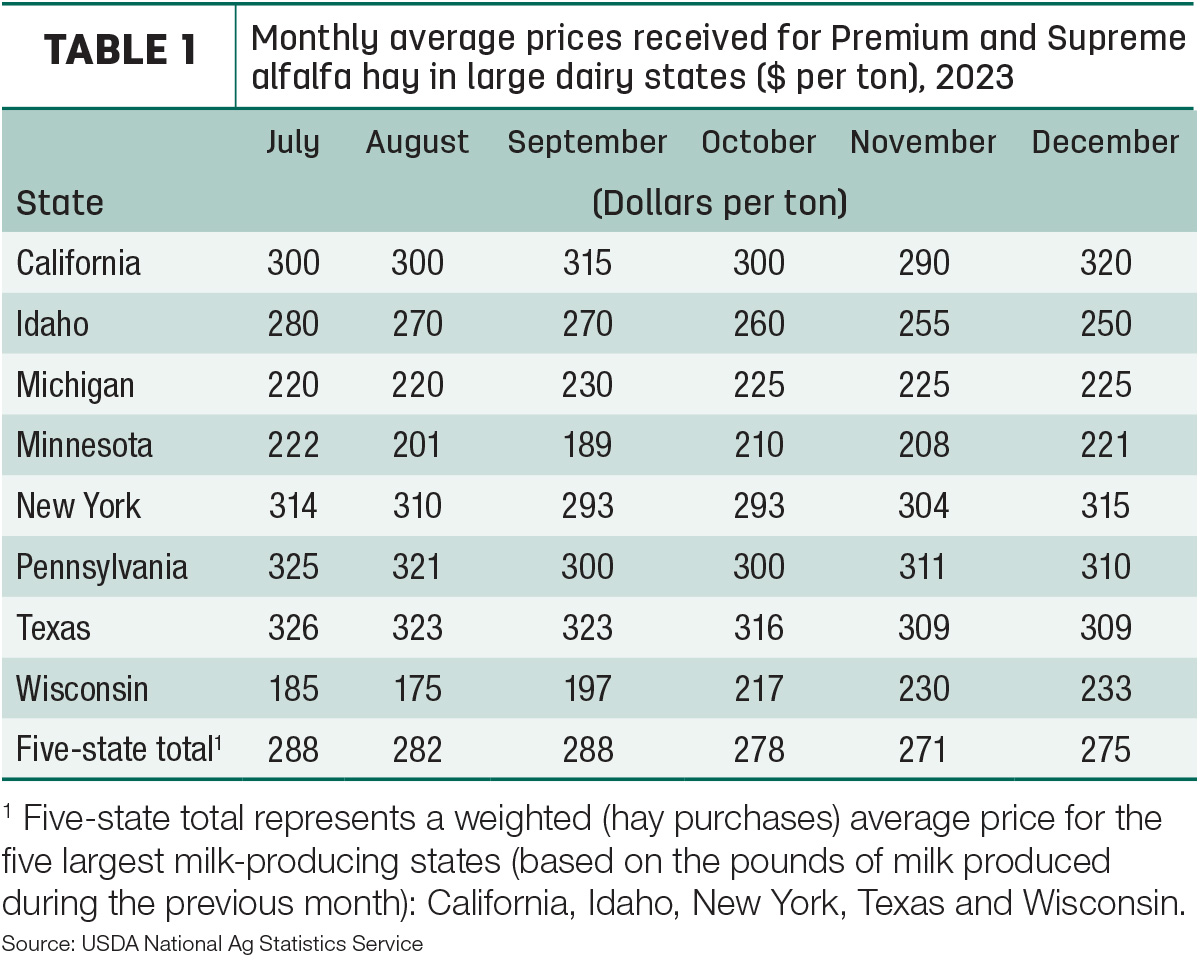

At $275 per ton, December’s average price for Premium and Supreme alfalfa hay in the top milk-producing states increased $4 from November. With December’s estimate, the 2023 average price for dairy-quality hay was $299 per ton, down about $5 from 2022 (Table 1).

Alfalfa

The U.S. average price for all alfalfa hay dipped $2 in December to $205 per ton, the lowest average price since July 2021. Compared with November, prices rose in just seven of 27 major forage states, led by increases in California, New York and Pennsylvania. Prices were lower in 16 states, with Nevada, New Mexico and Utah all down $20.

Year-over-year prices were down $125 to $135 or more in Arizona, California, Nevada and Utah.

Other hay

At $170 per ton, the December 2023 U.S. average price for other hay was unchanged from November. Prices increased in 10 of 27 major hay-producing states, with largest month-to-month increases in New York and Pennsylvania. Prices declined in 12 states, with average prices down $10 to $20 in Colorado, Minnesota, Nevada, New Mexico, Utah and Wyoming.

The December 2023 U.S. average price for other hay was down $10 per ton from a year earlier, led by declines of $140 in Nevada and $120 in Utah. Texas and Wisconsin recorded increases of $34 and $33, respectively.

The spread between U.S. average alfalfa and other hay prices – at more than $100 per ton last May and June – shrunk to $35 per ton in December, the slimmest gap since the first quarter of 2021.

Hay exports mixed

The pace of alfalfa hay exports increased to a three-month high in December, thanks to a jump in sales to China. Monthly exports were estimated at 210,626 metric tons (MT), with sales to China topping 112,400 MT, a high for the year. Sales to Saudi Arabia also hit a three-month high.

Looking at annual totals, alfalfa hay exports fell to 2.18 million MT, a nine-year low. Much of the decline can be attributed to a midyear softening of sales to China, which was the destination for about 41% of all U.S. alfalfa hay exports during the year.

At 83,124 MT, December exports of other hay were the lowest since August, with sales to both Japan and South Korea hitting five-month lows.

For the year, exports of other hay continued to soften, with the annual total of about 994,432 MT, the lowest volume in at least 17 years. Japan was the destination for 53% of other hay shipments during the year, followed by South Korea at 26%.

Regional markets

- Southwest: In California, demand for dairy and export hay was moderate. Retail hay demand was good. Another round of rain delayed hay cutting in parts of the state.

In Oklahoma, demand remained low and most hay producers were only delivering to longtime customers. Prices held strong on good-quality hay.

In Texas, hay prices were mostly steady. Hay was getting scarce, but buyer demand wasn’t as prominent this year due to a milder winter, allowing grazing.

- Northwest: In the Columbia Basin, trade remained slow with light to moderate demand. Export alfalfa sold steady in a light test.

In Montana, hay sales were light to moderate with steady to higher prices. Drought concerns were starting to weigh on ranchers in the western part of the state, and some were buying ahead as a precaution. Canada reentered the market with several sales sold on backhauls. Demand for dairy-quality hay was good as many dairies were finding high-test hay difficult to find. Many hay producers seem content with having some carryover as drought conditions expand.

In Idaho, trade remained slow. Prices for all grades of domestic hay and straw were steady. Demand was good from pellet mills seeking off-grade timothy.

In Colorado, trade activity was light on moderate demand. Retail and stable hay sold mostly steady; alfalfa and alfalfa-grass hay sold higher.

In Wyoming, hay sold steady on a thin test; demand was mostly light. Sales of beef cows across the state the past couple of years have reduced demand.

- Midwest: In Nebraska, buyer interest remained lower than expected. Alfalfa, grass hay, ground and delivered hay, and alfalfa pellets sold steady.

In Kansas, demand remained light and alfalfa prices were steady. Pellet mills, feedyards and grinders were still not in a buying mood. Grass hay, on the other hand, had continued to retain its value.

In South Dakota, demand was moderate for dairy-quality alfalfa and good for grass hay and for cornstalks. Livestock producers were having to bed heavily trying to keep their livestock dry in muddy conditions.

In Iowa, the market overall was steady to lower.

In Illinois, hay markets were mixed. A large auction in Madison County saw good demand with most packages selling higher. Elsewhere, large packages of hay sold lower.

In Missouri, hay movement was good as several farmers used more hay in January than they really wanted to, and it will be a while before there will be any grass. The supply of hay was light to moderate, demand was moderate to good and prices mostly steady.

- East: In Pennsylvania, demand and supply were moderate. Alfalfa, prairie/meadow grass, wheat straw and corn fodder sold steady; alfalfa/grass mix and orchardgrass sold steady with a weak undertone.

In Alabama, trade was moderate on moderate supply and good demand.

Other things we’re seeing

- Dairy: The USDA released its biannual Cattle report. As of Jan. 1, 2024, dairy cow numbers were estimated at 9.357 million head, the lowest to start a year since 2020. With lower cow numbers and increased crossbreeding to beef sires, the number of dairy replacement heifers to start the year is the lowest in two decades. That combination will limit milk production growth in 2024-25. Tightening cow and heifer numbers pushed average prices for U.S. replacement dairy cows to a nine-year high in January.

- Cattle: The USDA’s Cattle Inventory report indicated there were 28.2 million beef cows in the U.S. on Jan. 1, 2024, down about 2.5% compared to a year earlier and the fewest number of beef cows since 1961. The number of heifers held for beef cow replacement declined again, down 1.4%, placing a lid on herd expansion. Higher cattle prices and reduced feed costs will continue to improve margins, but drought, input costs and interest rates are headwinds.

- Fuel: Fuel prices started February with a slight uptick, according to the U.S. Energy Information Administration (EIA). The U.S. retail price for regular-grade gasoline averaged $3.14 per gallon on Feb. 5, up 4 cents from the previous week but down 41 cents from a year earlier. The average U.S. on-highway price of diesel was $3.90 per gallon, up about 3 cents per gallon from the prior week but 64 cents less than a year earlier.

- Trucking: Spot flatbed prices trended slightly higher to start February, averaging about $2.47 per mile nationally, according to DAT Trendlines. Regionally, average spot prices per mile were: Southeast – $2.53, Midwest – $2.78, South – $2.31, Northeast – $2.55 and West – $2.21.

- Tractor sales: U.S. farm tractor sales were mixed in 2023, with only the largest tractor categories posting increased sales compared to a year earlier, according to an annual summary from the Association of Equipment Manufacturers. Total 2023 sales of all two-wheel-drive tractors (245,701) were down 8.7% from 2022, offset somewhat by a 5% increase in tractors with more than 100 horsepower at 27,750. Sales of four-wheel-drive tractors were up almost 32% at 4,564.

- Interest rates: With the Federal Reserve holding the line on interest rates during a meeting in late January, interest rates on operating and ownership loans through the USDA’s Farm Service Agency were reduced to begin February 2024.

- Coming up: Scheduled for release on March 28, the survey-based USDA Prospective Planting report will provide an initial look at crop acreage estimates for 2024.